Responsible Investor

Managing our business prudently

The careful management of our business has created financial strength and shareholder value. We are proud of our history of steady investment and record of never taking a government bailout.

Benefitting from the complementary nature of our business

As a leading wealth manager in the US, a global asset manager and a differentiated insurance and annuity provider, Ameriprise is a powerful, diversified business. In addition to the broad capabilities we offer to clients, we also benefit from the intellectual capital and insights we draw from across the organization. This important perspective is essential to how we manage the firm, capture opportunities and manage risk.

Effectively managing risk

Enterprise risk management is an integral part of our business decision framework, as we believe a robust enterprise risk management program is critical to preserving and creating sustainable, long-term shareholder value and delivering for all our stakeholders. We devote significant resources to develop policies, procedures and controls to identify, monitor and manage risk, and our corporate values foster a culture of compliance and risk awareness.

Maintaining a strong financial foundation1

-

Strong ratings and risk management

-

High-quality, AA-rated investment portfolio

-

Strong liquidity with over $2 billion at the holding company

-

Effective hedging program

-

Appropriate debt levels

-

Excellent 90%+ free cash flow generation

-

Ability to invest for growth and return capital to shareholders at a differentiated rate

Offering a broad selection of investment options within Wealth Management

Ameriprise offers an extensive variety of investment options for clients, including Sustainable Investing and value-based investing products. In our wealth management business, we define Sustainable Investing to include three distinct areas:

- ESG integration that looks to consider ESG factors within the portfolio management process

- Impact investing that seeks to generate positive, measurable impact

- Value-based investing that seeks alignment with one’s values, typically by excluding certain sectors or companies

Columbia Threadneedle Investments is the global asset management business of Ameriprise Financial, Inc., managing assets on behalf of individual, institutional and corporate clients around the world. We strive to be responsible stewards of our clients’ assets, allocating their capital within a framework of robust research and good governance, with a breadth of capability and depth of expertise.

Retirement and protection solutions – benefitting from the investment capabilities at Columbia Threadneedle

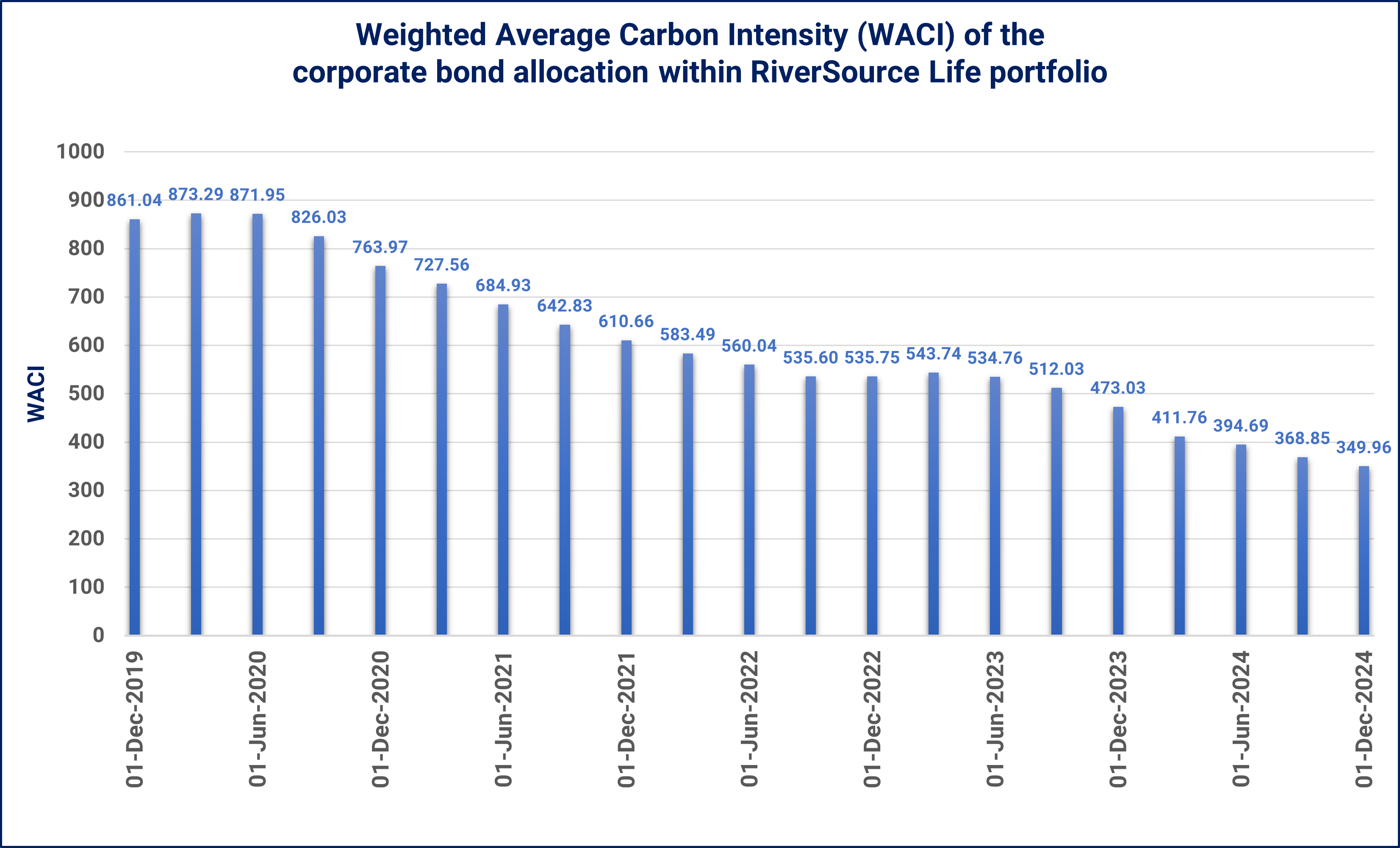

Columbia Threadneedle Investments manages the portfolio of RiverSource Life. The high-quality portfolio is invested in fixed income instruments with investment grade corporate bonds and mortgage-backed securities as sizable percentages. We manage the portfolio within specific investment and risk parameters to achieve its goal of meeting the current and long-term claims-paying ability of the business.

Investing in global energy transition

Our investment team has thoughtfully and strategically reduced the carbon intensity of the corporate bond allocation within the RiverSource Life portfolio while maintaining the overall portfolio’s quality. This reduction in carbon intensity reflects not only portfolio management actions, but also the issuers’ own steps to reduce their carbon footprints.

Ameriprise weighted average carbon intensity over time