Pass on your financial values to your children through different stages with these age-appropriate tips.

Whether earning through an allowance or a job, giving children hands-on experience with money can help them learn how to share, save, spend and grow their money wisely.

Here are 9 ways to teach kids financial literacy and share strong financial values with your child:

When they’re young (ages 5-13)

1. Consider the benefits of an allowance

Children can learn to appreciate the real-world prices of goods quickly when the money comes from their own pocket. By allowing your children to take responsibility for their money at an early age, they can learn how to budget and spend.

You can start teaching kids about money by giving them an allowance once they reach age 6 or 7. Consider increasing this sum of money — and financial responsibilities — over time. For example, when children are in preteen/teen years, it may make sense to give them money to cover their most routine expenses, from school lunches to clothing costs. If appropriate for your family, you could also tie the allowance to certain household chores.

See how parents approach money matters, instill financial values and balance competing priorities.

2. Reinforce a generous and responsible mindset

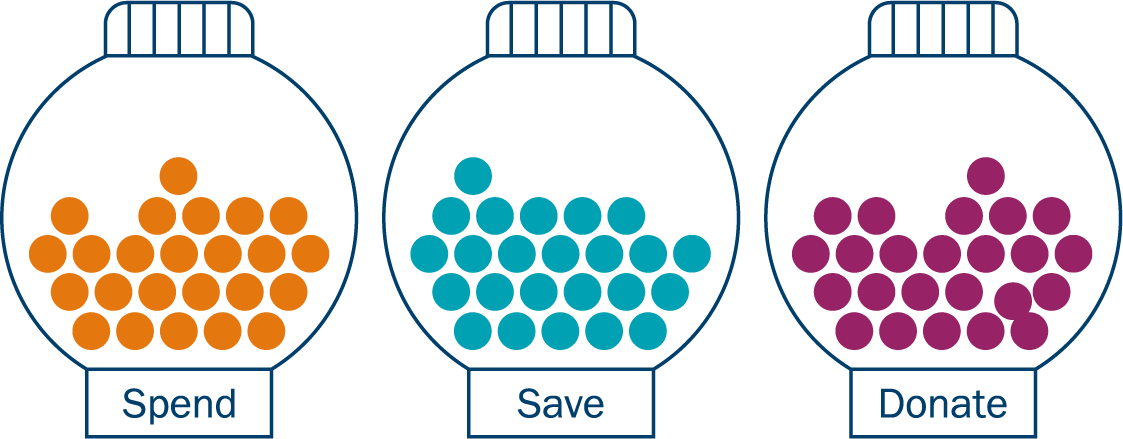

Like adults, children tend to be more generous when they give money to causes they connect with. One way to teach your children to be good savers and philanthropists is by encouraging them to split their money into three buckets:

- Spending

- Saving

- Donating

Encouraging your child to think about their money in these three ways can help reinforce the importance of financial planning.

3. Show them the perks of saving

It can be motivating to learn how money grows with the help of compounding interest. Teaching financial literacy for kids can start with simple, engaging lessons. Here are three ways you can help your children discover the benefits of saving:

- Help them open a savings account and teach them how their bank pays interest. Many banks offer special kids savings accounts.

- Provide an additional incentive by offering a match — for example, 50 cents on every dollar — on any money your kids, grandkids, or nieces and nephews deposit into their account.

- Consider CDs or money market accounts. Depending on how long it will be before the children tap their savings, it may be worth exploring certificates of deposit or money market accounts that offer better interest rates.

When they’re teenagers (ages 14-18)

4. Help them create good spending habits with a debit card

As your child enters the teen years, it may be time to open a checking account and teach them how to responsibly use a debit card. There are a variety of debit card options for minors — consider researching them with your teen.

Once you determine the right option for your family, talk openly about how the card should be used. Think of this trial run as your teen’s "debit card with training wheels" period. Like an allowance, a debit card can help teach kids about financial literacy by giving them the responsibility of budgeting their expenses.

5. Consider a part-time or summer job

Many teenagers are interested in a part-time job to earn extra spending money — and it can be an invaluable lesson in financial independence. Gaining work experience at a young age can help teens better understand the value of money, as well as expense management and taxes.

6. Expose them to investments and financial planning

At this point, your child may be ready for hands-on experience with stocks, bonds and mutual funds. As such, it may make sense to open a custodial brokerage account, which can come with many benefits. With my help, you can choose investment options together. For example, you may even give your teens the opportunity to own a few shares of their favorite computer company or clothing retailer. Additionally, tracking account performance is an excellent way for children to learn about stock market movements and how investing involves risk.

7. Give them insight into the family financial situation

Talking about money can be uncomfortable, but having a candid conversation about your family’s financial situation can offer your child helpful perspective as they contemplate their ideal career and lifestyle. For many families, this dialogue occurs when they sit down to complete the FAFSA for their child’s college education, but consider how and when you’d like to share these details. This can be a good opportunity to reinforce your financial values with your children and share how financial planning can be beneficial in the long term.

When they reach adulthood (18+)

8. Be their resource as they experience life’s many financial lessons

While 18 is the legal age of adulthood, many young adults are still likely to lean on their parents for guidance as they begin to manage their own finances. Whether you’re providing tax filing help, advice on financing a car, or assistance in setting up retirement accounts, these touchpoints are invaluable moments to pass on your financial values to your children. By being a resource to them and sharing what has (or hasn’t) worked for you, you can help foster financial literacy for your children and position them for a better financial future.

9. Introduce them to an Ameriprise financial advisor

It’s never too early to get advice for the multiple generations in your financial picture. As your child begins to set their first big financial goals, consider connecting them with your Ameriprise financial advisor. Your financial advisor intimately understands your family’s financial values and will help your child reach the financial milestones that are important to them while also balancing other goals like retirement.

Pass on your financial values

As you guide your children through life’s money lessons and help them build responsible financial values, know that you can always lean on your Ameriprise financial advisor for personalized guidance on how to teach kids about money.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.