Connect with a recruiter near you

If you’re nearing retirement but don’t have a succession plan for your practice, you’re not alone. It’s a common dilemma for advisors who remain busy serving clients and whose businesses have become increasingly complex over time. In fact, 73% of advisors don’t have a written succession plan.* Creating a strong plan is key to retiring on your own terms – and it’s easier than you might think.

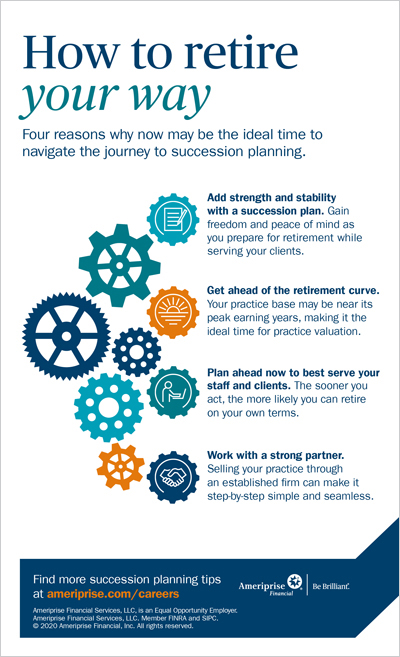

If you know you need a plan but haven’t made much progress, here are four reasons to begin — or update — your succession plan.

Interested in finding help navigating a more complex regulatory environment? Need new technology to satisfy consumer demand and mitigate risk? Hungry for broader access to training, products and services? Selling your practice can result in all of these things, while allowing you more freedom and time to spend on advising clients. When you do retire, you can rest easier knowing they’ll be well served.

“It’s a big decision, one that’s about more than just you and your retirement,” O’Connell says. “It’s about taking care of your clients and associates. The surprising news to many advisors is that a succession plan can actually make a practice stronger. It gives you peace of mind knowing that you have planned for your family, employees and clients.”

With the U.S. workforce trending older every year and a significant wave approaching retirement, it’s possible a large number of financial advisor business transfers will start to take place over the next few years.

For any advisor motivated to avoid the backside of the market, now is the time. You’ve been practicing long enough to build substantial AUM. Your client base may be in or near its peak earning years. When it comes to practice valuation, will things ever look as good on paper as they do now?

Maybe you want to take a step back while someone new takes the reins. Maybe you’ve already chosen a trusted associate as your successor. Or maybe you really do want to transition your practice and walk away. No matter the scenario, you can structure a deal

that works for you and retire your way.

“Not only is now an ideal time to tackle your succession plan, but now is also a really good time to consider working with a firm that can give you access to a bigger, better toolbox,” O’Connell says. “We allow advisors to retire in their own way while ensuring their practice continues to make a difference in their clients’ lives.”

Many advisors put off succession planning because they fear it will be too time consuming, too painful and too disruptive for clients. Working with Ameriprise can make things easier.

“From getting your practice on the market to valuation and due diligence to full-service integration planning, we can provide a proven path and time-tested methodology that make it possible to get what you want,” O’Connell says. “When it’s important to you to structure your sale to serve both your retirement needs and your clients’ long-term financial success, a solid firm with a team of specialists dedicated to supporting and helping manage your transition can make that happen — and make it easier,” O’Connell says.

Call our practice acquisition team at 1.888.267.8370 to learn more.

*Financial Planning Association, “Study: Succession Planning Remains a Challenge for Financial Advisors,” April 25, 2018.