How to plan for the cost of long-term care

Make a plan now for potential long-term care costs in the future.

Approximately 70% of people ages 65 and older will require long-term care sometime during their life.1 Given the considerable cost of such care, preparing for that possibility can help you protect your assets for other retirement and estate planning needs.

An Ameriprise financial advisor can help you explore your options for paying for the possibility of long-term care, while keeping you on track to accomplish your financial goals.

Here are answers to some of the most common questions about long-term care:

What is long-term care?

Long-term care refers to the assistance people with chronic illnesses, disabilities or sudden health events need over an extended period. It includes extra support with household tasks, daily physical activities (e.g., bathing, dressing and eating) and skilled care provided by nurses and other health care professionals.

The type and level of support often changes over time, and care can be provided in various settings, including one’s own home, an assisted living facility, an adult day care center, a nursing home or a hospice facility.

Is long-term care covered by Medicare or health insurance?

Whether provided by an employer or purchased privately, health insurance does not cover daily extended-care services. Medicare only covers up to 100 days in a skilled nursing facility. Though coverage of in-home assistance is unlimited under Medicare, it must be reordered by your physician every 60 days and meet certain conditions, and you may not get to choose the provider.

How much does long-term care cost?

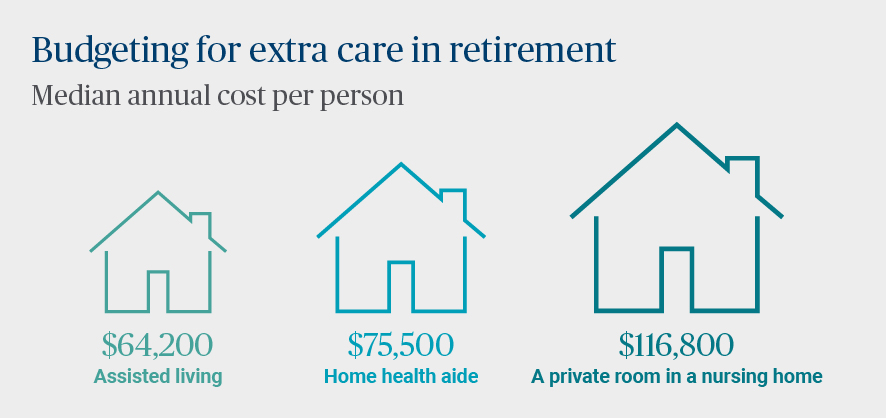

Long-term care costs can vary significantly based on where you live, where you receive it and the type of care needed. A survey conducted by Genworth Financial2 found long-term care costs to be significant and rising:

Source: Genworth Cost of Care Survey, 2023

How do people pay for long-term care costs?

There are four principal ways in which people fund long-term care:

- Self-funding: Some people can save enough for retirement to fund long-term care expenses out of pocket, though growth rates for long-term care expenses should be considered when determining how much to save. Using a home equity line of credit or a reverse mortgage are other self-funding options. If you plan to self-fund long-term care through your retirement accounts, be mindful of the potential tax impact. Taking larger distributions from pre-tax accounts, such as IRAs and 401(k) plans, for long-term care may bump you into a higher tax bracket.

- Family and friends: Reliance on family and friends to provide long-term care can be a solution for some people, but it can be physically and emotionally taxing — and is often not sustainable. Even when willing, an aging spouse may not be able to assist with certain activities, and adult children or grandchildren may not be in a position to help as needed.

- Government assistance: Though Medicare pays for up to 100 days of care, certain conditions must be met. In most states, to qualify for assistance through Medicaid, the countable assets of the person in long-term care must be depleted to roughly $2,000, though married couples are allowed more. Though there are strategies for transferring ownership of assets to meet the limitations, they are complicated and usually require the services of an attorney.

Additional government programs include long-term care benefits for military veterans from the Department of Veterans Affairs and elderly waiver programs, which provide home and community-based services for Medicaid-eligible seniors. When using government assistance, keep in mind that limited types of care and care facilities are covered by state funds and it varies by state, giving you less choice for where you can receive care.

- Long-term care insurance: If you qualify, long-term care insurance can help pay for long-term care services — and help protect your assets from the associated costs. Product types can vary widely in both cost and benefits. The best time to apply for coverage is when you’re healthy and still eligible. The cost of traditional long-term care insurance may be significant, especially considering it may never be needed. Hybrid life/long-term care insurance or life insurance with a long-term care rider are other options to consider if you want flexibility in how you may use the insurance benefits.

When should I start planning for the possibility of long-term care costs?

Because every person has a unique health situation, the exact age and timing will be different for everyone. Generally, start thinking about how to protect assets from potential costs of long-term care in the context of your overall financial plan. If you’re interested in long-term care insurance, you’ll want to purchase a policy when you’re still healthy. As you age, you can develop conditions that may make long-term care coverage more expensive or even inaccessible.

Ultimately, your medical history will play a big role in how you plan for long-term care costs. For example, if your family has a history of early-onset Alzheimer’s, Huntington’s disease or another debilitating medical condition, you may need to start planning for the potential for long-term care earlier.

Advice spotlight

If you are relatively healthy, purchasing long-term care insurance between the ages of 50 and 65 is generally more cost-effective. Doing so typically allows people to take advantage of lower costs associated with being healthier while avoiding paying premiums for an extended period. While the need for long-term care can happen at any age, most long-term care insurance claims begin when people are in their 80s.

What other factors should I consider as I plan for long-term care?

Consider what type of care you might need, where you would prefer to receive care, the potential involvement of others and the associated costs. For example, if you become injured or ill to the extent that you require full-time assistance, who will help you with bathing, getting dressed, meal preparation, household chores, potential physical therapy or medical services? Will it involve help from your spouse, willing and available loved ones, nurses or a combination of support? Have a conversation with the loved ones in your life about your plans, so they’re aligned with your choices.

How does financial planning for long-term care help protect my estate plan?

Proactive planning for costs of long-term care can help protect your assets and preserve the legacy you plan to leave to your loved ones. Long-term care is expensive and, if not accounted for in your retirement strategy, it can deplete the funds you plan to leave to your heirs. Solutions like long-term care insurance — including life insurance with optional riders — can help you transfer the risk of such costs and avoid exhausting the assets you hope to pass on.

We’re here to help you plan for the long term

There is no one-size-fits-all solution when it comes to planning and paying for long-term care, but an Ameriprise advisor can help you understand your options — and help you find a strategy that’s right for you, your legacy and your financial goals.

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

warning Something went wrong. Do you want to try reloading? Try again

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.