Find out how this financial measure is calculated and consider strategies that can help maintain a healthy credit score.

Building and maintaining a good credit score is key to personal finance management, affecting everything from the mortgage rates you qualify for to the insurance carriers that will cover you. At its core, your credit score can act as a tailwind, or a headwind, in your journey to your financial goals.

An Ameriprise financial advisor can help you understand your credit score and how it may affect your current financial goals. To get you started, here’s a guide to credit scores and how to strengthen and maintain a strong ranking over time.

What is a credit score? And how can it affect my financial goals?

A credit score is a three-digit number that summarizes a person’s creditworthiness based on their credit history. It helps potential lenders evaluate how risky you are as a borrower. However, its impact also can go beyond credit cards and loans. Property managers, potential employers and insurance companies, among others, may also use credit scores in evaluating potential tenants, employees or policyholders.

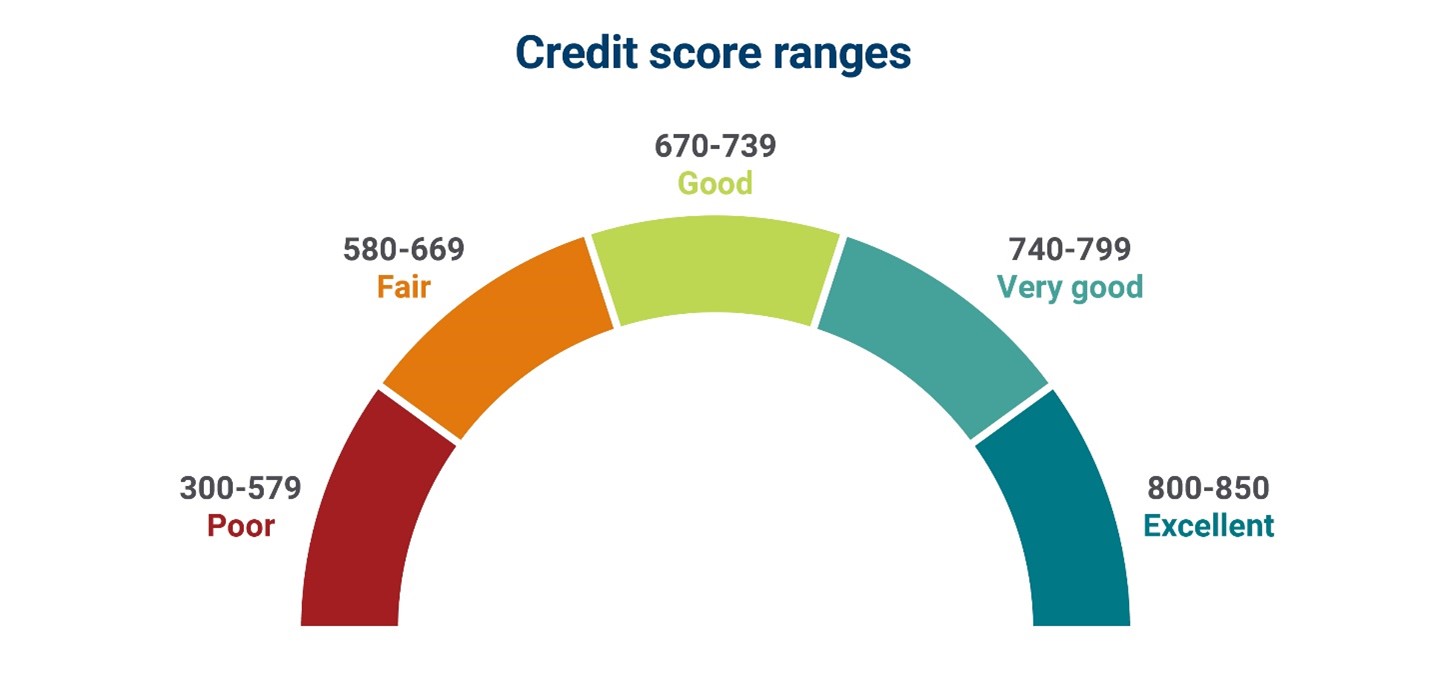

Source: FICO. Graphic used for illustrative purposes only1

How your credit score is calculated

Credit agencies base your score on several factors, each weighted slightly differently, according to FICO2:

- Payment history (35%): Your record of making on-time payments.

- Amount owed (30%): This factors in how many of your accounts have balances, how much you owe and your credit utilization ratio, which is the percentage of your total credit limit you are currently using. The lower your credit utilization ratio, the better.

- Credit history (15%): How long you’ve had your accounts. The longer, the better.

- New credit (10%): This considers how many credit checks — for loans, credit cards or lines of credit — you’ve had in the last 12-18 months. Having a high number of credit inquiries can negatively impact your score.

- Credit mix (10%): This tracks the different kinds of credit you have, including revolving, installment or open. Having and responsibly managing a mix of credit can help your score.

Learn more: Strategies to help pay off debt faster

How to build a credit score, if you don’t have a credit history

To have a credit score, you need to have credit. And while a car loan or personal loan is one way to achieve this, starting on a smaller scale can be a good idea.

One way to start building a credit history is by opening a pre-paid credit card with your bank. Though it generally isn’t wise to hold a balance on your cards, interest needs to be charged at least once for it to materialize in your credit rating. As such, consider making a small purchase, paying the minimum payment for the first month and then paying off the full balance in the following months.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Strategies that can help maintain or improve your credit score

There are several things you can do to help develop and improve your score over time:

- Pay your bills on time. The most significant factor in determining your credit score is your payment history, so making timely payments is critical. To achieve this, consider setting up automatic payments.

- Minimize credit utilization ratio. A low credit utilization rate — only using a small percentage of your available credit limit — shows you aren’t maxing out your credit cards or overspending. You can calculate this number by adding up what you owe on all revolving credit accounts and dividing that number by your total credit limits for those accounts. Aim to keep this number below 20 percent to maintain a good score.

- Limit your credit applications. Applying for a lot of credit over a short time span, especially for credit cards, can have a negative impact on your score. (Inquiries for auto or personal loans in a short period are treated as a single inquiry.)

- Keep an eye on your credit report. Monitor your credit score and review your credit reports at least once a year with all three national credit bureau agencies: Equifax, Experian and TransUnion. Look for any errors or signs of fraud so that you can catch and correct them before they impact your score.

- Be cautious when closing accounts. Closing accounts, even ones you don’t use often, can negatively impact your credit score by shortening your credit history and shrinking your available credit limit, which will affect your credit utilization ratio.

See how parents approach money matters, instill financial values and balance competing priorities.

How often should you check your credit score?

You should check your credit score at least once a year, to stay apprised of your standing and to ensure there isn’t any fraudulent activity. But you can check your credit score as often as you like (in fact, tracking the progress you’re making with this number can be encouraging). Contrary to popular belief, checking your credit score frequently will not negatively affect your rating.

How to protect your credit score if you suspect fraud

Putting a freeze on your credit can reduce the risk of someone fraudulently opening a credit account in your name, as it prohibits credit agencies from disclosing your credit report to anyone requesting the data. A credit freeze won’t impact your credit score or your ability to use your existing credit accounts. Just remember you will need to lift the freeze — with all three credit agencies — whenever you apply for a new credit account.

Use your credit score to help reach your financial goals

An Ameriprise financial advisor can help you better understand how your credit score can factor into your overall strategy to achieve your financial goals.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.