How a systematic savings plan can help you reach your goals

Use this strategy to help build your cash reserve, boost your retirement portfolio and save for life’s other goals.

With life’s many competing priorities, you’re likely balancing saving for multiple goals at once. Retirement, education costs and other life events may all be vying for your dollars.

So how can you consistently make progress toward these different savings goals? One option to consider is a systematic savings plan, in which you automatically set aside a specific amount of your income at regular intervals to build your savings.

An Ameriprise financial advisor can help you balance saving for life’s many needs, while also helping to keep you on track for retirement.

Here’s how to create a systematic savings plan that works for you:

What is a systematic savings plan?

With a systematic savings plan, you set aside a specific amount of your income at regular intervals for a particular savings goal. By practicing this “pay yourself first” strategy, you treat that goal as a regular expense — instead of setting aside whatever you have left at the end of each month.

Learn more: Establishing a cash reserve: How much should you have?

How to create an individual systematic savings plan to fund your goals

1. Define your goal and how much you want to save

Having a specific savings target can help you stay on track even as you juggle other competing priorities. Perhaps you want to renovate your home, purchase a new home or augment your retirement savings. Whatever your savings goal, define the amount you want to save.

While saving that amount of money may seem daunting, don’t worry. The key is to start the process early. Even if your initial contributions are small, the savings can add up quickly.

Advice spotlight

Keep your financial goals on track by prioritizing a healthy cash reserve. While your unique needs and lifestyle will determine what savings goals are the most time sensitive and urgent for you, building up a sufficient emergency fund — if you don’t already have one — is key as it acts as one of the first lines of defense in protecting your financial goals.

2. Determine your time horizon and calculate the cadence and size of regular contribution

After you decide on your savings goal, consider your time horizon and how much you can set aside on a regular basis. Some savings goals, like retirement, will require regular contributions over decades. Other goals, like a healthy cash reserve, can be achieved in a shorter period. Either way, it’s important to take your time horizon into account so that you can estimate how frequently, and how much, you can practically save.

Advice spotlight

Strategically time your withdrawals and deposits to keep your cash flow running smoothly. When you start to save money systematically, consider the timing of any other automatic payments, such as auto or student loan payments, so that you don’t inadvertently stress your cash flow.

3. Decide where to house your savings

One of the last decisions to make is where to save and the best method for transferring the funds.

- Automatic payroll transfer: Many employers’ payroll plans allow you to automatically deposit various portions of your paycheck into different accounts. If that's an option, consider setting up a specific account for your goal and an automatic payroll transfer to deposit part of your paycheck.

- Transfer between different bank accounts: An alternative to your employer’s payroll, most banks and credit unions will let you set up automatic transfers between your checking account and other kinds of accounts, even if they are at other institutions. In that case, you can have your checking account serve as a hub and regularly schedule automatic transfers into savings accounts you designate for your different goals.

- Leverage investment/retirement accounts: Many financial institutions, brokerage firms and mutual fund companies allow you to transfer money between their different savings and investment vehicles automatically. For example, if your time horizon for saving is longer because you’re saving for retirement —make sure you’re transferring your savings into accounts where the money can be invested and you can get a tax advantage, like a 401(k) or IRA.

Use a systematic savings plan to save for retirement

For many investors, a systematic savings plan is foundational to their retirement investment strategy as it offers an easy way to incrementally set aside money for one of life’s largest financial goals.

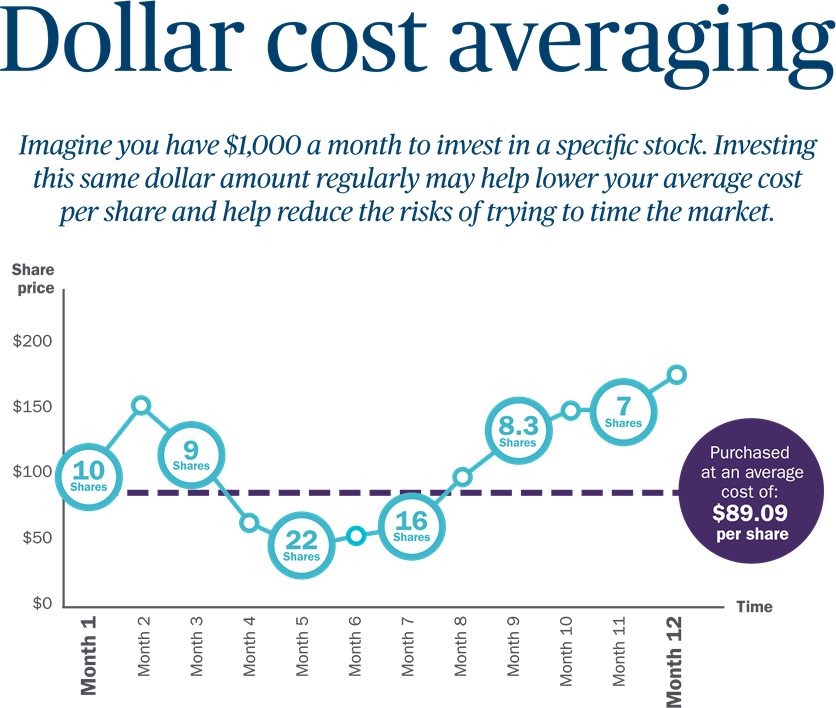

Many investors, for example, use automatic payroll transfer to systematically contribute to their 401(k) plans. Some also take advantage of automatic increases over time to boost their savings. And dollar-cost averaging — where you invest a certain amount of money at regular intervals, regardless of what the market is doing — is built on the principle of systematic savings.

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

warning Something went wrong. Do you want to try reloading? Try again

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.