How to plan for retirement

Retirement is typically the biggest financial goal people save for in their lifetime.

Below are key retirement planning steps to help you get started.

Determine how much money you need to plan for retirement

The actual amount you need for retirement depends on many variables unique to your situation, including your lifestyle and expenses when you retire. It also depends on factors out of your control, such as inflation, health care costs and life expectancy.

Estimate your retirement expenses

The first step in determining how much money you need to save is understanding your anticipated expenses in retirement. This will help you calculate the income you need when you are no longer working. Here are questions to ask yourself:

- At what age do you expect to retire? If you plan to retire early, you’ll want to save even more to ensure your savings will last for a long retirement.

- What is your desired retirement lifestyle? Think about what you’d like to do when you’re no longer working. How do you envision your life? Don’t just think about your day-to-day budget but give some thought to your retirement dreams.

- What about your life expectancy? Consider your family history and current health when thinking about how much you’ll need to save.

- Are you accounting for inflation? Inflation is one of the biggest factors to consider when planning for retirement. Almost everything — from big-ticket items like houses, to small things like a pack of gum — goes up in value over time. Your income will likely have to increase year over year just to maintain the same standard of living. At an inflation rate of 4 percent a year, prices may potentially double in just 18 years and at 3 percent a year, prices may potentially double in about 24 years. This inflation calculator can help you determine how your retirement savings may be affected by inflation over time.

Estimate your retirement income

You can generally plan for your annual retirement income needs to be 70 to 80 percent of your pre-retirement income. When you’re further away from retirement, it can be hard to project how your income might change over the years — so it's okay to make an educated guess.

To generate income in retirement, you may rely on a combination of savings, Social Security and pensions:

- Retirement savings accounts. There are many different types of retirement savings accounts available to help you save — and it’s common to use more than one to create a well-rounded retirement income stream. There are advantages to each account type, such as employer matching with a 401(k) or 403(b), or tax-free income in retirement from a Roth IRA and more. Learn more about the pros and cons of different retirement accounts.

- Social Security. The amount of Social Security benefits you receive will depend on your lifetime earnings and the age at which you start collecting benefits. Learn about when you should collect Social Security, and visit the Social Security website or refer to your Social Security benefit statement for your projected benefit amount.

- Pension plans. If you have a pension, you qualify for a monthly benefit that is usually based on your years of service, salary and age at retirement. All or some of your pension may be guaranteed by the federal government, and various options for your payments are available. Learn more about pension payments and find out how much you can expect to receive by contacting your HR department.

Once you have an idea of your retirement vision and income, it’s important to revisit your goals and projections annually with your financial advisor.

The benefits of saving for retirement early

By saving regularly over several decades, even small contributions can grow to a substantial nest egg by the time you retire.

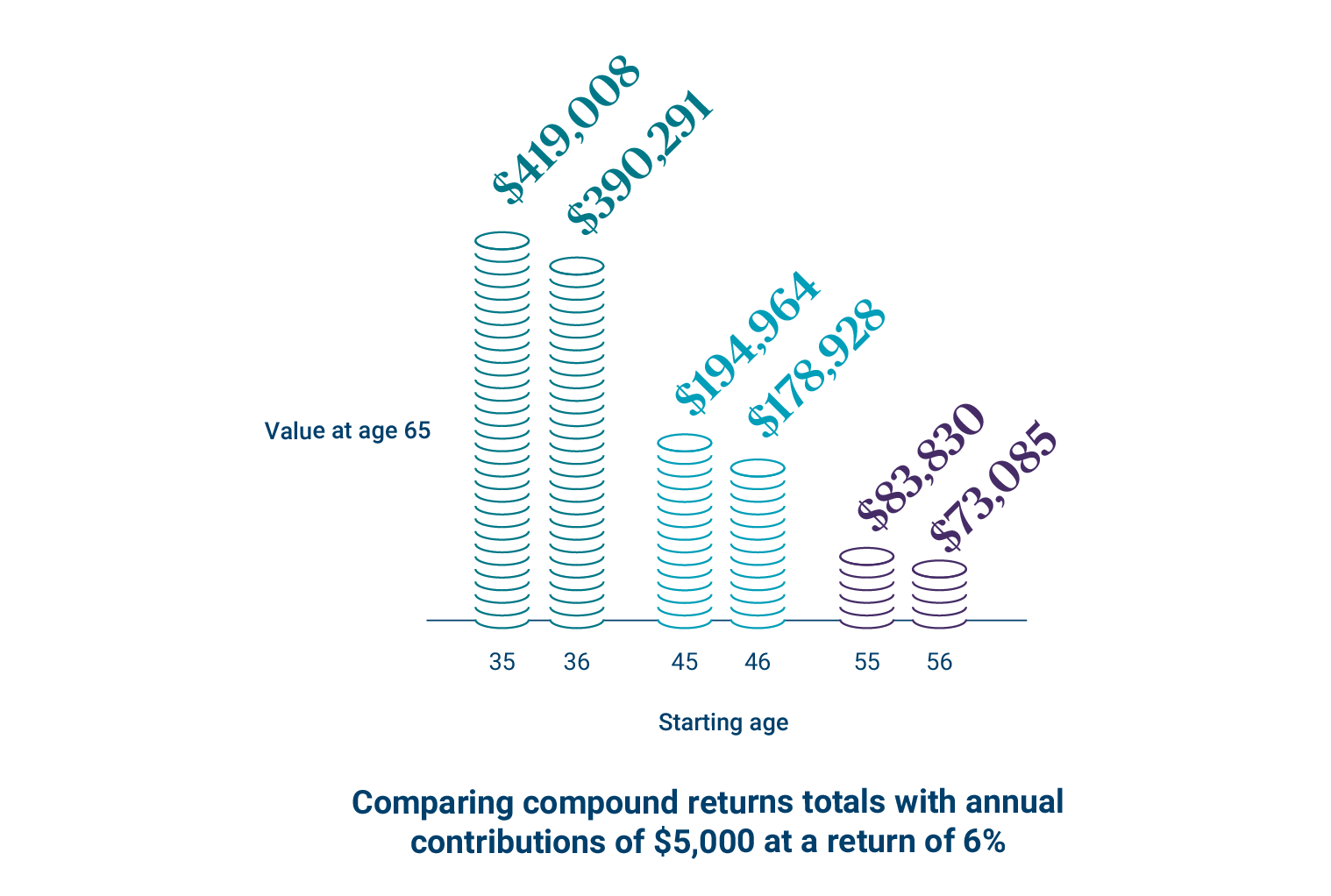

The power of compounding returns

Compounding returns can help you save far more than the amount you invest. In the example below, $150,000 (made up of 30 annual contributions of $5,000) grows to $419,000 over 30 years. In other words, $269,000 — or 64 percent — of the total is created by the power of compounding returns.

This illustration is hypothetical and does not reflect any actual investment. Investment values will fluctuate. This illustration is only intended to demonstrate the mathematical principle behind compounding returns.

Take advantage of dollar-cost averaging

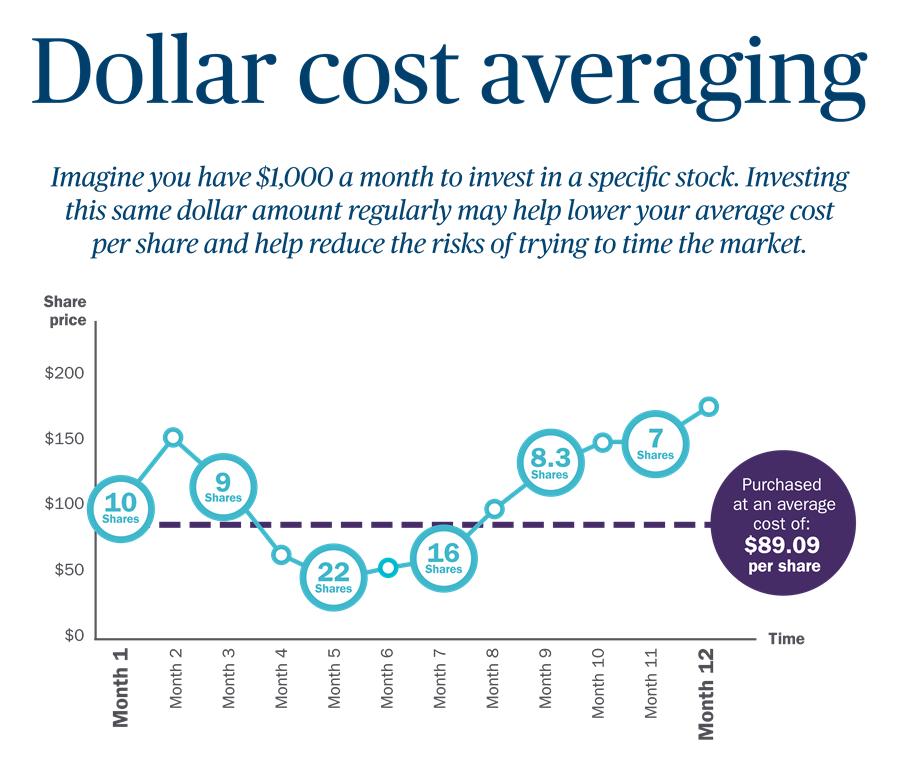

Ideally, your retirement assets will grow from year to year. Even in a down market, it's critical to continue investing. Consistently investing the same amount over time throughout natural market cycles is a strategy known as dollar-cost averaging. Over the long term, this strategy can help reduce the impact of market volatility.

This illustration is hypothetical; is not guaranteed nor intended to represent any specific investment.

With dollar-cost averaging, you naturally buy fewer shares when the market is high and more shares when the market is low. This systematic approach can help you gradually build wealth by diversifying the prices at which you buy more shares of a stock, for example. (Neither price appreciation nor profit is guaranteed, however.) It’s a way to hedge the risk of buying too much at high prices and too little at low prices.

Save more as your salary increases

The next time you get a raise or bonus, consider dedicating some or all of it to your retirement savings. If you do this before you get used to having the extra income, you may not even notice a difference.

Other factors to consider

Avoid early withdrawals

Although you can withdraw money from an IRA account before you reach age 59½, it's generally not a good idea. For starters, you'll have to pay taxes and possibly a 10% IRS early withdrawal penalty on earnings and pre-tax contributions you withdraw. You also risk your retirement savings goal in two ways: You may not be able to replace the assets, and even if you can, you may miss out on years of growth.

For other (non-IRA) types of retirement plans, you cannot take an early withdrawal unless you are age 59½ or older, leave your job or qualify for a hardship distribution. If you leave your employer prior to the year you turned 55 and you are not yet 59½, you may have to pay a penalty in addition to income tax. If you are still working for your employer, however, you may have a loan option available. Learn more about borrowing or withdrawing money from your 401(k) plan.

What to do if you come up short in your retirement savings

You still have options. If you’re able to wait to collect Social Security retirement benefits, you can increase your monthly benefit amount. Each month you delay collection, your eligible benefit increases, until you reach the maximum amount at age 70. See how your Social Security benefits change depending on when you start collecting.

You can also consider working in retirement. By earning money, you can rely less on your savings and you may be able to find a role that allows you to use your skills in a meaningful way. With more companies allowing remote or flexible work arrangements, you may find that working in retirement is a fulfilling way to spend some of your time while earning extra income to support your lifestyle.

It’s never too late (or early) to start saving for retirement

There's no one-size-fits-all answer to the question of how much you'll need to save for retirement. It’s important to have a plan and begin saving as early as you reasonably can.

An Ameriprise financial advisor can help you document your goals, track your progress and update your retirement strategy as your circumstances change over time.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.