2024 elections: How may the results impact my investments?

Anthony Saglimbene, Chief Market Strategist – Ameriprise Financial

Nov. 20, 2024

This article is intended to provide perspective on how election outcomes may impact financial markets, the economy and investments. These insights are not political statements from Ameriprise Financial, nor an endorsement of a particular candidate or political party.

After an eventful election cycle, the 2024 presidential and congressional races have concluded. Former President Donald J. Trump will become the 47th president of the United States, making him only the second president in U.S. history to serve nonconsecutive terms. He will begin his second presidency with both chambers of Congress controlled by the Republican party.

What may these results mean for the markets, the economy and your portfolio? Here are our key takeaways:

A decisive presidential victory eases market anxiety

Coming into election day, three key outstanding questions about the presidential race weighed on market sentiment and, in our view, acted to elevate investor anxiety in the weeks leading up to the event.

- Would the result be decisive or opaque?

- Would the presidential result be contested?

- How soon would we know the winner?

On all three fronts, investors didn't have to wait long for the answers, which almost immediately reduced investor anxiety around these unknowns in the days following the election. President-elect Trump won key battleground states, leading to a clear electoral college win, and also captured the popular vote. These swift and clear results eliminated any concerns regarding a contested election or lengthy court battles, as Vice President Kamala Harris quickly conceded the election.

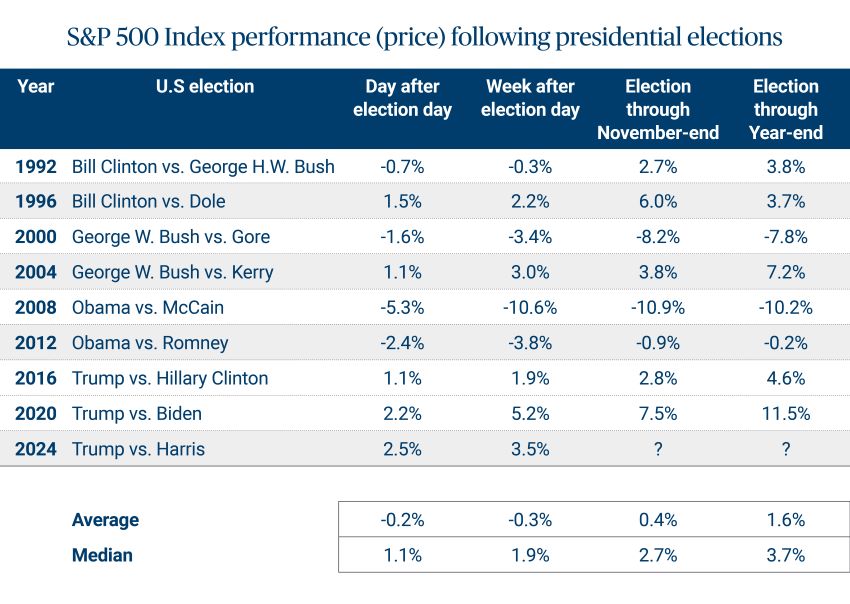

Sources: Bloomberg and American Enterprise Investment Services, Inc. S&P 500 performance is measured from close of election day through stated period. These figures are shown for illustrative purposes only, are not guaranteed and do not reflect any actual investment or investment strategy. Past performance is not a guarantee of future results. An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

What a second Trump term may mean for the markets and the economy

Before we dive into the specific market and economic implications, we’ll preface our commentary with an important fact: In general, presidential election outcomes have a limited effect on the long-term performance of the broader markets and the economy. Factors such as economic growth and corporate profits typically drive market performance longer term. Still, an administration’s policies can add to, or detract from, the momentum driving the markets and the economy forward.

Here are our key takeaways:

- Republican control in the Senate and House likely removes any chances of sweeping tax hikes on corporations and wealthy individuals — a longer-term market positive, in our view. Notably, Republicans have vowed to chip away at President Joe Biden's green energy policies/laws, roll back regulations on energy production, strengthen the U.S.-Mexico border and extend the 2017 Tax Cuts and Jobs Act, which was slated to sunset at the end of 2025.

- In the area of tax policy, President-elect Trump has proposed lowering the corporate tax rate from 21% to 15%. According to Goldman Sachs, this could boost S&P 500 earnings by roughly +4.0% over current estimates. In 2017, the Tax Cuts and Jobs Act boosted S&P 500 earnings per share (EPS) by +12% in 2018. Current FactSet estimates call for S&P 500 EPS to grow by +14.6% year-over-year on revenue growth of +5.6%. But investors should be cautious about assuming lower taxes are coming next year until there is a proposed bill that can realistically pass through both chambers.

- In the days following the election results, small-cap stocks, the financial sector, select Big Tech firms and U.S. Treasury yields made large moves higher. Small-cap stocks are expected to benefit from the potential for lower taxes, increased domestic production (i.e., a U.S.-first policy) and possibly better trends in regional banking. Further, the backdrop for the financial sector could improve as less regulation and the potential for merger/acquisition and capital market activity accelerate.

- While momentum can continue to carry some of these areas further, current fundamentals — like profit conditions, valuations and economic activity — still matter. However, there is much undetermined about how a second Trump administration will increase “already” solid growth trends, lower/maintain tax rates and affect global supply chains as there is the potential for increased tariffs on imports to the U.S.

- A second Trump administration will likely inherit a strong market. U.S. stocks are trading at or near all-time highs and sitting on very healthy year-to-date gains, with all S&P 500 sectors expected to grow profits in 2025. Corporate fundamentals are on solid ground, profits are expected to grow over the coming quarters and stock prices reflect a healthy environment.

- While consumers (and voters) may feel differently, Trump is also expected to start his next term with a more favorable economic environment. Inflation has ebbed lower all year, the Federal Reserve is in the process of lowering its policy rate and government bond yields should move lower over the next six to 12 months, in our view. Additionally, labor conditions in the U.S. remain on firm ground and the U.S. economy is growing. In fact, U.S. gross domestic product (GDP) has grown in 16 of the last 17 quarters.

- Normalized inflation levels should continue to relieve pressures on consumers and businesses over time. Notably, lower interest rates could help add support for lending activities, business investment and improve affordability across larger-ticket consumer items, such as homes and automobiles. America is working, and consumers/businesses are spending. As a result, U.S. growth trends remain positive.

Don’t let politics sway your investment decisions

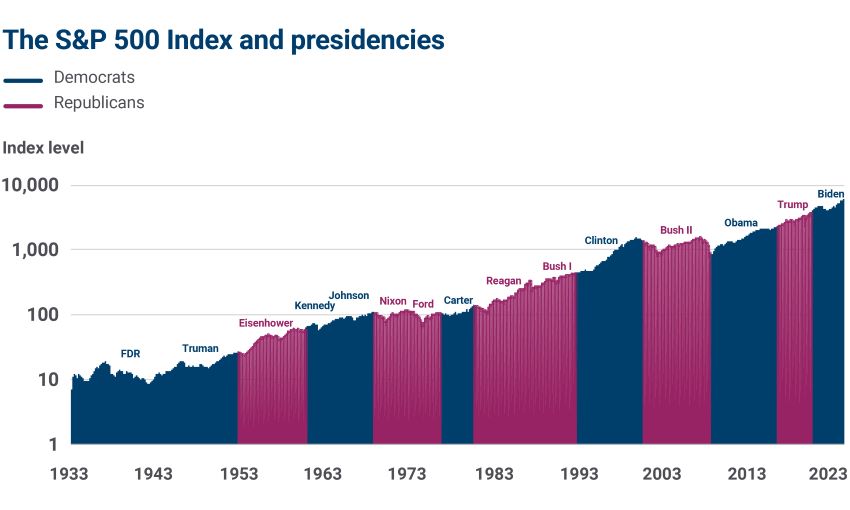

While it’s easy to get caught up in the election news cycle, it’s important to remember that — regardless of who is in the White House — the market tends to rise in any given year.

Sources: Bloomberg and American Enterprise Investment Services. Data through Nov. 6, 2024. These figures are shown for illustrative purposes only, are not guaranteed and do not reflect any actual investment or investment strategy. Past performance is not a guarantee of future results. An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

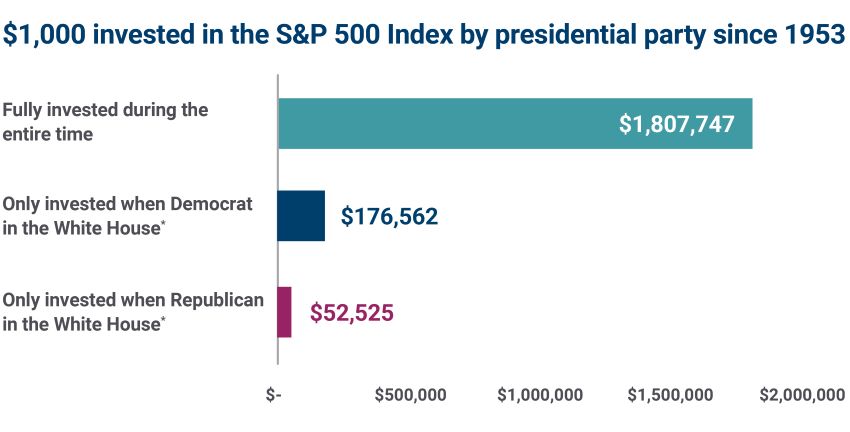

As our charts in this article show, investing in stocks throughout changes in presidential administrations produces better results compared to only investing when your preferred party sits in the White House. And while you may not agree with a president and the fiscal policies of an opposing party, history clearly shows politics is seldom a reason not to invest. Rather, a better approach is to adhere to a well-diversified investment approach.

* For the periods when not investing in the stock market, we assume a cash return using 1M Treasury rate.

Sources: FactSet, Morningstar, Standard & Poor's, American Enterprise Investment Services, Inc. Data as of Oct. 31, 2024. These figures are shown for illustrative purposes only, are not guaranteed and do not reflect any actual investment or investment strategy. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. Past performance is not a guarantee of future results. An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Finally, we believe investors should stick with a disciplined investment strategy and use any potential volatility between now and year-end to your advantage by deploying a systematic dollar-cost-averaging approach into stocks and bonds with excess cash earmarked for investments. Further, as the year winds down, it’s a smart time to review your portfolio with your Ameriprise financial advisor, and make sure your asset allocation is aligned to your financial goals, time horizon and risk tolerance.