NVIDIA earnings this week will provide investors insight into the current “Face of AI”

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — February 24, 2025

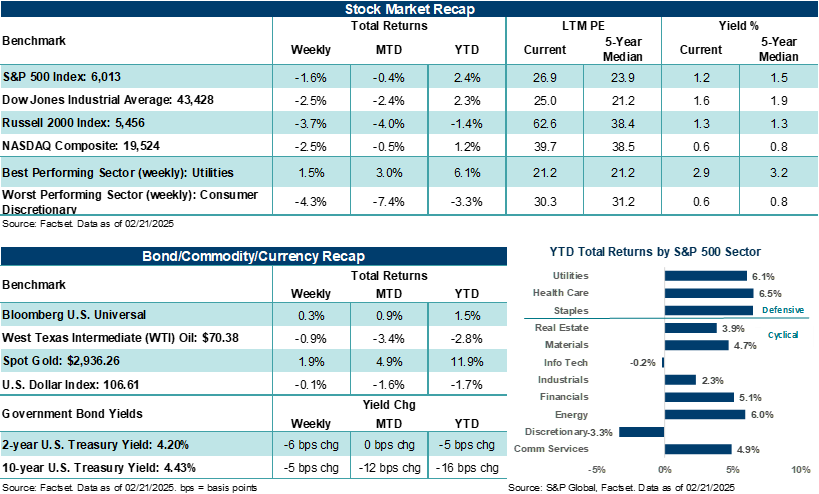

Stocks buckled last week under mounting economic data that suggests the uncertainty surrounding inflation and tariff conditions in the U.S. and abroad are beginning to weigh heavily on consumers' and investors' attitudes about the future. Major U.S. stock averages finished last week lower, with the S&P 500 Index logging its worst day of 2025 on Friday.

Home data, February Consumer Confidence, and the January Personal Consumption Expenditures (PCE) Price Index line the economic calendar this week. However, Big Tech will be in investors' crosshairs, with NVIDIA reporting fourth quarter results on Wednesday. Its outlook for artificial intelligence, demand for its Hopper/Blackwell chips, infrastructure/cloud trends, and commentary on AI modeling following DeepSeek developments will all likely shape investor reactions to NVIDIA results and may have broader implications for sentiment and stock direction moving forward.

Last week in review:

-

After hitting new all-time highs on Tuesday and Wednesday, the S&P 500 fell on Thursday and Friday to end the week lower by 1.6%.

-

The NASDAQ Composite ended lower by 2.5%. Pressure across Magnificent Seven stocks such as Meta Platforms (-7.2%), Amazon (-5.3%), and Tesla (-5.1%) weighed on the index.

“NVIDIA represents roughly 6.5% of the S&P 500, 10.5% of the NASDAQ Composite, and almost 20.5% of the S&P 500 Information Technology Index. The stock’s influence on major U.S. stock averages, as well as Technology as a whole, can’t be understated, in our view. “

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The Dow Jones Industrials Average (-2.5%) and Russell 2000 Index (-3.7%) were weighed down by weaker-than-expected profit guidance from Walmart and growing concerns that tariffs, inflation, and elevated interest rates could dampen profit growth across smaller companies.

-

U.S. Treasury yields dipped lower as traders and investors revisited the diversification properties that government bonds offer when stocks are under stress.

- Gold edged higher, again hitting a fresh record high during the week.

- The U.S. Dollar Index and West Texas Intermediate (WTI) crude finished little changed.

- Friday’s economic releases offered a more sobering (and unexpected) view of the current environment, with February's preliminary looks at manufacturing and services activity coming in much weaker than forecast. The composite figure (including manufacturing and services activity) fell to a 17-month low this month, coming in well below estimates and barely holding on to an expansionary level. Notably, services activity (the main engine of U.S. growth) contracted in February for the first time in two years, falling meaningfully from January levels. New order growth weakened sharply, and business expectations for the year slumped due to uncertainty related to federal government policies.

- A final read on February University of Michigan consumer sentiment showed longer-term inflation expectations rising to their highest level in almost three decades. Growing concern over mounting U.S. tariff threats contributed to the survey’s inflation outlook over the next five years, rising to +3.5% — the highest rate since 1995. All five components of the sentiment survey fell in February, with over half of consumers expecting the unemployment rate to rise over the next year — the highest rate since 2020. Digging deeper, much of the spike in the survey’s pessimism comes from consumers who identify as Democrat. That said, inflation expectations are on the rise, which is the opposite of what Federal Reserve officials want to see at this point in their campaign to bring inflation back to their +2.0% target.

- On a related note, the minutes from the January Fed meeting essentially said policymakers are comfortable holding rates steady until they see further data on inflation and growth trends and have more details on Trump administration policies, including on tariffs and immigration. Market odds predominantly point to the Fed holding its policy rate steady through its next two meetings (i.e., March and May).

- Finally, on the White House front, President Trump floated the idea of imposing additional tariffs on autos, semiconductors, and pharmaceuticals. In addition, the President said a new China trade deal is possible, while the European Union is ready to reduce tariffs to avoid a trade war.

Investors finally get their chance to poke around the company that arguably remains the face of AI.

Though some could argue with the idea that NVIDIA is “the” face of artificial intelligence in this early stage, there are few, if any, companies that are as synonymous with AI technology and have reaped as much benefit in changing the trajectory of its revenue arch than the Santa Clara company founded by CEO Jensen Huang. Since the public release of ChatGPT on November 30, 2022, NVIDIA’s stock is up +694% cumulatively on a price basis, trouncing the NASDAQ Composite’s return of +70% and the S&P 500’s return of +47%. One main reason for the stunning outperformance over this period has been the front-and-center role NVIDIA’s graphic processing unit (GPU) semiconductors have played in supplying the brains to train AI models and build the infrastructure around the technology. Companies, including Alphabet, Microsoft, Amazon, and Meta Platforms, have spent hundreds of billions of dollars to create and build AI architecture. For the most part, NVIDIA’s chips have been the only game in town to help develop AI technology. Thus, these companies’ capital expenditures over multiple quarters have helped fuel NVIDIA’s dramatic rise in revenue and, hence, its stock price.

But with NVIDIA’s ever-increasing revenue, fading ability to “smash” analyst profit estimates each quarter as it had in its earlier rise, and an already pretty dramatic increase in its stock price and valuation over recent years, the law of large numbers and large expectations is beginning to catch up with the stock.

Since the announcement of DeepSeek (a Chinese AI startup that “allegedly” trained its models for less money and on less sophisticated chips), NVIDIA’s stock has faced a more challenging environment. While the stock is up nearly +12% in February and handily outpacing the broader U.S. stock averages this month, NVIDIA is meaningfully underperforming over the trailing one-month, three-month, six-month, and year-to-date periods. Bottom line: There is very little room for NVIDIA to disappoint analyst profit expectations this year, given its assumed leadership position in AI, already elevated valuations, and new developments and entrants in the space that could threaten its dominance over time.

Following the close of U.S. market trading on Wednesday, NVIDIA will report its latest quarterly results. The company’s data center segment, which includes the bulk of the company’s AI chips and services, is expected to show revenue doubled to $113 billion for the fiscal year ending in January. However, the transition from its Hopper AI chip to the new, faster Blackwell chips could show a deceleration in revenue growth during the most recent quarter compared to previous quarters. That said, recent earnings reports and commentary from Alphabet, Amazon, and Meta Platforms all pointed to continued and aggressive spending on AI this year and noted their strong relationship with NVIDIA. Thus, it stands to reason that the revenue outlook for NVIDIA over the coming quarters looks solid despite potential hiccups in how investors interpret near-term results or the influence of other outside factors (e.g., DeepSeek or increased competition).

Bottom line: NVIDIA represents roughly 6.5% of the S&P 500, 10.5% of the NASDAQ Composite, and almost 20.5% of the S&P 500 Information Technology Index. The stock’s influence on major U.S. stock averages, as well as Technology as a whole, can’t be understated, in our view. Investors will soon have the chance to see NVIDIA’s latest earnings results and outlook following developments over recent weeks that may or may not challenge its perch at the top of the AI mountain. Our advice? Don’t get overly consumed with the near-term results. Expect some potential bumps in the road this year for NVIDIA, Technology stocks, and possibly broader averages. However, AI trends remain secular. NVIDIA should continue to be a beneficiary of capital spending in the space, and, historically, potential dislocations in industry leaders or the market as a whole can create longer-term opportunities for investors willing to look through short-term disruptions.

The week ahead:

In addition to the focus on AI and NVIDIA, it’s also a busy week for investors on the economic side.

- Tuesday’s February Consumer Confidence report is expected to dip to a five-month low amid growing inflation and policy concerns.

- A second look at Q4’24 U.S. GDP on Thursday should remain unchanged at +2.3%, while home data on prices and new/pending sales line the week.

- Friday’s January PCE report is forecast to show the Fed’s preferred inflation gauge edged higher on a month-over-month basis, with personal income expected to tick lower from December levels. Note: CPI and PPI reports for January came in hotter than expected.

These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.