When it comes to AI, we’re still tailgating in the parking lot

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — November 25, 2024

Stocks bounced higher last week, as the S&P 500 Index has risen in two of the previous three weeks. Corporate earnings results were a large focus, with NVIDIA, Walmart, and Target helping shape outlooks on trends across artificial intelligence and the holiday shopping season. In the background, speculation around President-elect Trump’s U.S. Treasury Secretary pick, as well as updated reads on economic activity and housing, kept headlines busy.

The week ahead will see U.S. markets closed for Thanksgiving on Thursday (and closed early on Friday), a modest loss in productivity as Americans get busy on their holiday shopping lists, and several economic releases, including November consumer confidence.

Last week in review:

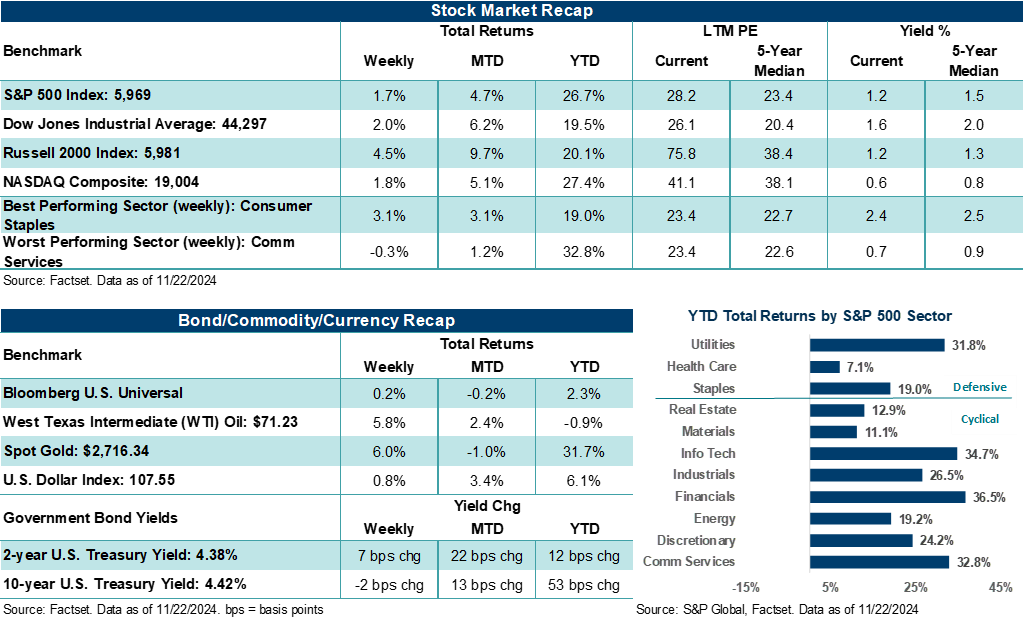

- The S&P 500 rose +1.7%. The broad-based stock benchmark is higher by +3.2% since the November 5 election, and up +4.7% in November. With the year winding down and the benchmark up nearly +27.0% this year, the S&P 500 is on pace to record its second consecutive year of +20.0%+ returns — a first since 1998-1999.

“Simply, we believe the world is still very early in its adoption of AI, which leaves ample room for investment opportunity if a disciplined approach is maintained, and importantly, investors avoid getting carried away on the AI-hype train.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The NASDAQ Composite also gained +1.7% on the week. NVIDIA's latest earnings update shows the artificial intelligence semiconductor maker continues to fire on all cylinders. Elevated "whisper" numbers aside, earnings per share (EPS) handily beat estimates, with revenue coming in at $35.1 billion in the previous quarter, rising an impressive +94% year-over-year. And while annualized revenue growth slowed from the last three quarters of +122%, +262%, and +265%, respectively, the sales growth seen at NVIDIA remains the envy of the world. Importantly, Data Center revenue, the growth engine of the company, grew to $30.8 billion in the previous quarter, up +112% from a year ago. However, NVIDIA finished the week flat, given that the stock was already higher by over +190% this year coming into last week’s earnings release.

- On the retail front, Walmart and Target saw very different stock reactions following their latest earnings reports. Walmart rose +7.4% on the week after beating earnings estimates, surpassing even the most aggressive U.S. comparisons ex-fuel, and raising their full-year profit guidance. Conversely, Target fell nearly 18.0%, missing most key metrics and flagging increased weakness across higher-margin discretionary items. With the holiday shopping season gearing up this week, retailers that have the right mix of items, control inventory well, and have a good sense of what their customers will be shopping for could see their stocks rewarded. However, retailers that are less equipped to handle a more discerning holiday shopper this year may be forced to increase promotional activity, which could cut into fourth quarter profits and margins.

- The Dow Jones Industrials Average and Russell 2000 Index rose +2.0% and +4.5%, respectively.

- U.S. Treasury prices finished mixed across the curve. The U.S. Dollar Index was stronger across other major currencies. Gold rallied higher after three weeks of declines, and West Texas Intermediate (WTI) crude settled higher, more than erasing the previous week’s declines.

- On the economic front, a preliminary look at November manufacturing and services activity showed that the combination of each rose to its highest level since April 2022, driven by continued strength in services activity. On the housing front, October housing starts missed estimates, partly due to weather impacts, and home builder sentiment rose to its highest level in seven months.

- President-elect Trump nominated hedge fund executive Scott Bessent to be his U.S. Treasury Secretary. Bessent is the founder of Key Square Group, is seen as a fiscal hawk, and, if confirmed by the Senate, will be responsible for enacting Trump’s economic agenda, including forthcoming U.S. tariff policies. Bessent’s known positions include following a gradual tariff policy approach, leaning on less regulation to drive business growth and control inflation, and supporting policies that promote U.S. energy and manufacturing independence.

When it comes to AI, some of us are still tailgating in the parking lot.

In our view, the Artificial Intelligence Revolution is just beginning, and investors should think of AI as comparable to the Industrial Revolution and other major technological advancements seen across human history. While the world has gone to great lengths over recent decades to digitize all types of information, AI has the capabilities to quickly "connect" and "synthesize" massive amounts of digital data and information, creating pathways, analysis, and new ways of powering efficiencies across all types of industries that otherwise would not be possible without this new technology. Simply, we believe the world is still very early in its adoption of AI, which leaves ample room for investment opportunity if a disciplined approach is maintained, and importantly, investors avoid getting carried away on the “AI-hype train.”

For investors, it's crucial to be realistic about AI's near-term profit and growth expectations. Technology and the companies that operate in AI will likely experience periods of booms and busts across a long secular time frame (say 5-10 years), and today's AI leaders may eventually be surpassed by new technologies and companies that don’t exist today. In our view, AI-related software could be the next large phase of development once the infrastructure and data centers that fuel all this computing genius are more accessible to smaller players. In this regard, and compared to a sports analogy, the players are still warming up on the field (i.e., the AI architects). The spectators are starting to make their way into the stadium (i.e., all the businesses and governments trying to figure out how to use AI). And for the rest of us? We’re still tailgating in the parking lot (i.e., consumers are still waiting for AI to significantly enhance/disrupt/change their lives).

Most investors with a few decades of experience vividly remember the dotcom bust and the pain it caused on portfolios in the early 2000s. Yet those same investors sometimes forget the amount of wealth that was created in the mid-to-late 1990s during a period of rapid technological advancement (i.e., the advent of wireless communication, personal computer adoption, and the world’s introduction to the internet). In our view, we are entering a similar state of rapid technological advancement. Often, investors who got burned by the dotcom bust overextended their portfolios in high-flying technology names, used leverage to boost returns, and when those investments failed, sat in cash too long and missed the opportunity to either reinvest or ride out the storm in higher quality investments. Our advice is to think more about the opportunities that lie ahead in technology over the coming years and less about what can go wrong or if AI is just the next dotcom bust waiting to happen. If one maintains a disciplined investment approach, keeps tech exposure sized correctly to their risk tolerance, and pairs that with other diversified investment options, we believe investors could be well-equipped to benefit from what may very well turn out to be revolutionary technological advancement over the next five to ten years.

The week ahead:

Early reads on the holiday shopping season will likely be a focus for investors as the week winds down and as Americans make their way from the Thanksgiving table to malls (and their couches) to grab anticipated holiday discounts.

-

The National Retail Federation (NRF) estimates that overall holiday sales growth this year will increase by +2.5% to +3.5% compared to last year. NRF estimates Americans will spend a total of $979.5 billion to $989 billion between November 1 and December 31, up from $955.6 billion in 2023.

- Adobe forecasts that online retail spending between November 1 and December 31 will reach a record $241 billion — an +8.4% increase over 2023 levels. Mobile shopping is expected to account for up to +53.2% of that total, with Buy Now, Pay Later predicted to grow to $18.5 billion, representing an +11.5% increase over last year. For those of us looking for gift ideas, Adobe notes this year’s must-have items include Bluey toys, smartphones, Bluetooth headphones, MDA’s Miniverse, and Call of Duty: Black Ops 6.

- On the economic front, Tuesday’s November Consumer Confidence report is expected to show an increase over October levels and may rise to a ten-month high. A second look at Q3 GDP, home data, Fed meeting minutes, and October PCE also line the holiday-shortened calendar.

- Lastly, have a safe and festive Thanksgiving holiday with friends and family.