Can big tech keep delivering?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — January 27, 2025

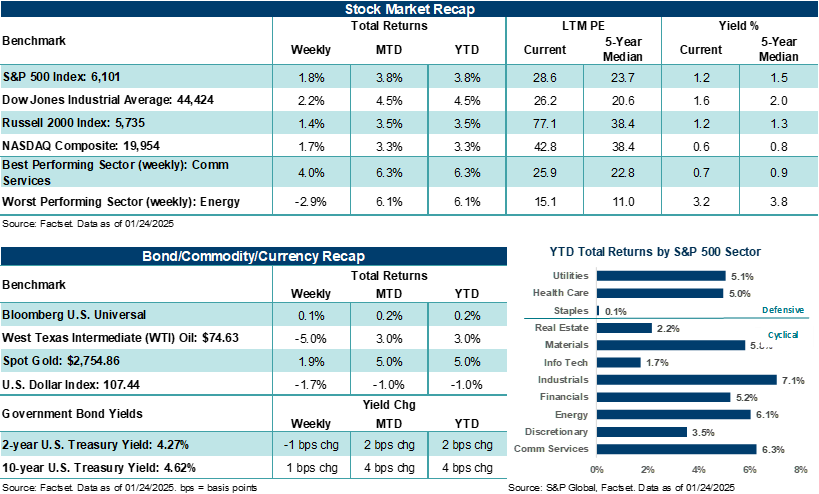

The S&P 500 Index notched its second straight week of gains last week and opens this week on pace to record positive performance in January following losses in December. Much of investors’ attention last week centered on a flurry of policy announcements coming out of the new Trump administration as well as the steady ramp higher in fourth quarter corporate earnings reports. In the background, economic updates on manufacturing and services activity pointed to firm, but mixed results.

The Federal Reserve will hold its first policy meeting of the year on Tuesday and Wednesday this week. Market odds suggest policymakers will hold rates steady at the conclusion of its two-day meeting. However, statement language and comments from Fed Chair Powell following the meeting on how the committee sees rate policy evolving over the coming months is where investors will likely look for more information. Outside of the Fed this week, roughly 20% of the S&P 500 will report fourth quarter profit results, while a batch of home data and a first look at Q4 U.S. GDP are on tap.

Last week in review:

-

The S&P 500 gained +1.8%. According to Bloomberg, the Index recorded its best start to a presidential term since Ronald Reagan was sworn into office in 1985. Notably, the Index claimed a new all-time high on Thursday, surpassing its previous closing high made on December 6.

“We see profit growth broadening in 2025 to areas outside of Big Tech. However, we also believe for broader markets to move higher this year, expectations for the companies that have driven the current bull market thus far will likely need to be met and, in some cases, surpassed, which is no small feat.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The NASDAQ Composite rose +1.7%. President Trump’s announcement of a $500 billion joint AI infrastructure project named “Stargate” helped sentiment around several technology-related companies, including Oracle. A strong earnings and outlook from Netflix and Meta Platforms saying it would spend up to $65 billion in 2025 to fulfill AI goals also provided tailwinds for the tech-heavy index.

- The Dow Jones Industrials Average jumped +2.2%, while the Russell 2000 Index gained +1.4%. Notably, cyclical sectors such as industrials, energy, financials, and materials are experiencing outsized performance compared to the major U.S. stock averages in January.

- U.S. Treasury yields remained largely static on the week.

- West Texas Intermediate (WTI) crude saw its first weekly drop of the year, falling 5.0%. President Trump calling for lower oil prices, as well as Russian President Vladimir Putin saying he would discuss energy issues with the U.S. president weighed on crude prices.

- The U.S. Dollar Index weakened against the major currencies, particularly against the euro and sterling.

- Out of the gate, President Trump has rescinded seventy-eight Biden executive orders, ordered U.S. agencies to study current trade policies with other nations and suggest actions by April 1, created the External Revenue Service to collect tariffs, declared a national emergency at the southern border, and invoked emergency powers to help boost domestic energy production. Further, President Trump has renamed the U.S. Digital Service to the Department of Government Efficiency, announced a joint AI infrastructure project, said he might impose 25% tariffs on Mexico and Canada by February 1, and is considering further tariff actions on China and other nations. On all these fronts, details are light, final plans remain fluid, and much needs to be negotiated between interested parties. Interestingly, Trump has continued to suggest the corporate tax rate could drop from 21% to 15% for companies that manufacture in the U.S., stressed that taxes on individuals should not rise, and that his administration will focus on policies that promote "deregulation" and put American interests first. Bottom line: The absence of day-one tariff actions and what appears to be measured steps from the new administration to use tariff threats as leverage to help spur American interests had investors breathing a sigh of relief last week. Hence, stocks rallied.

- With 16% of S&P 500 fourth quarter reports complete, blended earnings per share (EPS) growth is higher by a very healthy +12.7% year-over-year on revenue growth of +4.6%. Notably, 80% of the companies reporting profit results have surpassed EPS estimates, which is above the five-year average of 77%.

- Finally, preliminary looks at January PMI showed manufacturing activity climbing back into expansion for the first time in six months, while services activity came in at its weakest level since April 2024. The composite figure (manufacturing and services combined) remained in expansionary territory but hit a nine-month low. Also, preliminary January Michigan consumer sentiment fell for the first time in six months, while year-ahead inflation expectations jumped from +2.8% to +3.2%.

Can Big Tech keep delivering?

Last year, the Magnificent Seven (i.e., Tesla, Meta Platforms, Microsoft, Apple, Amazon, Alphabet, and NVIDIA) accounted for more than half of the S&P 500’s roughly +25% return. According to Bespoke Investment Group, the U.S. stock market’s current bull market run since the release of ChatGPT on November 30, 2022, is most correlated with the period associated with the introduction of the first modern web browser, Netscape, back in 1994. The NASDAQ Composite’s performance since the release of ChatGPT has seen a correlation of 0.94 with its performance during the introduction of Netscape at the same point in time. On a related note, the S&P 500’s new closing high on Thursday marks the latest confirmation that the bull market remains alive and well. For the S&P 500, the current bull market has run for 834 calendar days and returned roughly +71% on a price basis. Also, according to Bespoke, the S&P 500’s current bull market duration and return are near the historical “median,” but returns and duration remain well shy of the “average.” Going back to 1928, the average S&P 500 bull market run has lasted 1,011 days and returned +114.4%. Bottom line: Statistics measuring the correlation of the current bull market with other significant events over time or looking at the duration and return of a major U.S. stock index compared to other periods comes down to one driving force in this cycle — Big Tech.

On Wednesday, Meta Platforms, Microsoft, and Tesla will report their profit results for the previous quarter. On Thursday, Amazon and Apple will follow up with their results. In our view, the importance of these companies to the overall profit narrative can’t be understated, given their size and influence in driving higher U.S. earnings growth as well as the prices of the broader averages since the start of the current bull market. Along with Amazon playing an outsized role in driving profit growth for Consumer Discretionary and the broader S&P 500 in the fourth quarter, several companies within the Magnificent Seven are expected to have a heavy influence on driving S&P 500 profit growth in Q4. In fact, the Mag Seven as a whole are expected to report year-over-year earnings per share (EPS) growth of +21.7% in the final quarter of 2024 versus +9.7% for the other 493 companies in the S&P 500. Interestingly, the profit gap between the Mag Seven and the rest of the market is expected to narrow this year. Yet this exclusive group of companies, as well as Big Tech in general, are still likely to be very notable drivers of earnings growth in 2025.

Though we expect Big Tech results to come in strong for the previous quarter, outlooks in this space will likely play the dominant feature when these key companies report this week, given already high expectations for AI growth over the coming quarters and elevated valuations. Bottom line: We anticipate profit growth broadening in 2025 to areas outside of Big Tech. However, we also believe for broader markets to move higher this year, expectations for the companies that have driven the current bull market thus far will likely need to be met and, in some cases, surpassed, which is no small feat. This week, investors will get their first looks at whether Big Tech can keep coming up big and delivering on pretty lofty expectations.

The week ahead:

Outside of Big Tech earnings this week, a Fed meeting and economic releases will keep investors busy.

- The Federal Reserve is likely to leave its policy rate unchanged on Wednesday, following three consecutive cuts of 100 basis points in total since September. Outside of the U.S., the European Central Bank is expected to cut its policy rate by 25 basis points.

- We expect a first look at Q4’24 U.S. GDP on Thursday to show the U.S. economy grew by a healthy +2.7%, following the +2.8% pace it recorded in Q3’24. Housing data, January Consumer Confidence, and December PCE also line the economic calendar.

Weekly Market Perspectives will return on February 10th.