As the Fed mulls rate cuts, is fixed income still a smart bet?

Brian Erickson, Fixed Income Strategist – Ameriprise Financial

Jan. 20, 2025

Fixed income yields have been a bright spot for investors over the past few years as the Federal Reserve hiked policy rates to levels not seen in nearly two decades. But now that the monetary policy environment is less restrictive, will bonds remain a compelling opportunity?

Here’s our 2025 fixed income outlook:

Bright prospects for a new year

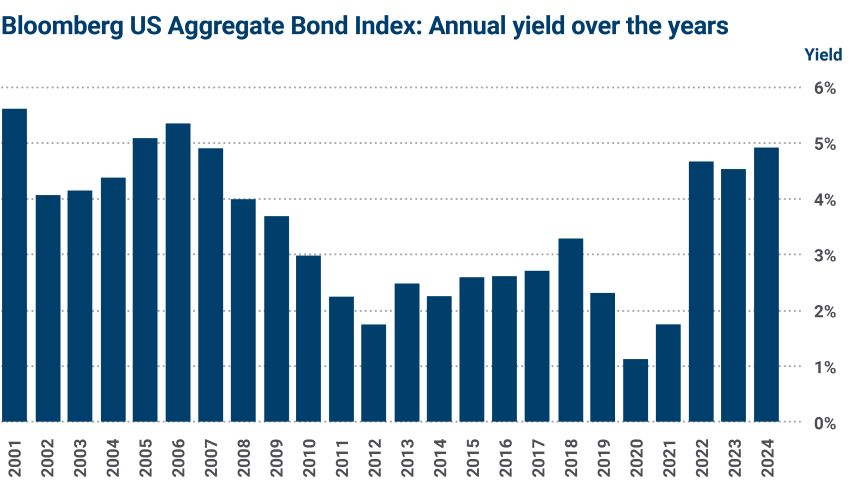

As the new year begins, fixed income yields remain quite attractive: The Bloomberg US Aggregate Index, the standard benchmark for high-quality fixed income, offered a nearly 5% yield at the end of 2024. That is a quarter of a percent higher than a year prior. For bond investments, higher yields equate to lower prices. You cannot often purchase investments at a lower cost than a year ago; inflation tends to make that challenging. Yet, on an inflation-adjusted basis, the nearly 5% yield of high-quality fixed-income investments is double that of inflation expectations.

Source: Bloomberg L.P. This example is shown for illustrative purposes only and is not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Dynamics to watch

At the top of our list are inflation, the core Personal Consumption Expenditures Price Index (PCE, the Fed’s preferred indicator of sustained inflation) and the Consumer Price Index (CPI, a measure of rising prices consumers pay at the store). As the new presidential administration takes office, greater clarity around potential fiscal stimulus and regulatory reform could shape potential demand-driven inflation. Further, trade and immigration disruptions, in addition to pressure from both hot and cold conflicts around the globe, could also drive supply-side inflation. We anticipate the geopolitical climate may lead to supply disruptions as a more regular contributor of upside inflation surprises going forward.

- Inflation: The inflation impact of supply and demand changes ultimately influences the path of Fed rate policy and how the Treasury curve likely evolves through 2025. At this point, bond markets price in a slow half-of-a-percent cut to the federal funds rate this year. Stubborn inflation could slow that pace, while further deceleration may open the door to more Fed rate cuts. In general, we forecast long-term Treasury yields to end the year roughly where they began.

- Geopolitics: 2025 may see bumpier government bond markets in the U.S. and around the globe due to several dynamics that remain in flux this year. Deglobalization has companies diversifying supply chains to reduce disruption due to trade tensions. Politically, the incoming presidential administration aims for meaningful change in spending, tax, immigration and regulatory policies. Depending on how each evolves, there may be implications for inflation or financing deficit spending.

- National debt financing: Each time the Treasury auctions a block of new debt, it tests investor willingness to fund the U.S. government. The U.S. Treasury will need to finance roughly $12 trillion this year, according to the Congressional Budget Office deficit forecasts and Bloomberg L.P. While a substantial amount of debt, the global role of the U.S. dollar is significant, and there’s an expansive range of investors that rely on U.S. Treasuries for cash management, collateral and investment. We do not expect that reliance will change in the foreseeable future.

Potential opportunities for investors

It’s our view that peak inflation, Fed policy rates and 10-year Treasury yields are a thing of the past. However, we do see a modest risk that inflation progress could stagnate and that the Fed may reverse recent policy rate cuts. As such, we anticipate fixed income yields to hold steady or to modestly decline should growth and inflation settle lower, as our economist forecasts. The overall direction for rates is sideways to lower, which sets up meaningful total return prospects this year. Here are a few opportunities to consider:

- Reassess your cash allocation: Investors who still own excess cash investments may consider deploying that capital into fixed income to earn today’s yields for years to come and for the potential boost in total return performance should growth slow.

- Active management may be beneficial: Passive approaches to high-quality bonds may have been sufficient in past years, but active management may prove its value in 2025. With inflation, growth, politics and trade relations in flux as we enter the year, an active manager with a sufficiently broad core-plus mandate may benefit from the dexterity and breadth of diversification to navigate 2025 as it unfolds.

- Remain diversified within fixed income: Even without active management, we suggest broadly spreading high-quality bond allocations among Treasuries, agencies, highly rated corporates and municipals where appropriate.

- Consider corporate bonds: We believe companies and the bonds they issue rest soundly on growth prospects and strong demand for investment as we start the year. Spread premiums hover near their lowest levels of the past decade; a solid labor market for consumers, steady growth and easy borrowing conditions shape an environment where companies can grow and thrive. The spread premium is in addition to attractive Treasury yields relative to the past decade and relative to inflation expectations. An active approach to corporate investment allows investors to parse leaders from laggards as the AI revolution spills into energy, real estate, technology and other tangential segments.

Bottom line

Overall, we have a constructive view of fixed income investment prospects for 2025. Talk to your Ameriprise financial advisor about how to appropriately position your fixed income investments for the new year and put these insights into action.