2025 housing market outlook: 3 factors to watch

Russell Price, Chief Economist – Ameriprise Financial

March 17, 2025

The housing market’s 2025 spring selling season has begun. Here are some factors that are likely to influence the housing markets this year:

1. High mortgage rates are likely here to stay

We believe mortgage borrowing costs could decline in 2025 but not by much. At the time of this writing, the national average rate on a 30-year fixed mortgage is about 7%. We believe the average rate for the full year is likely to be about 6.5%. Rates in the 6.0% to 7.0% range are likely to be the new normal for mortgage costs for the foreseeable future, in our view.

How much impact do higher mortgage rates have? For a $400,000 home, a 30-year mortgage rate of 7.0% (with 20% down) would result in a monthly mortgage payment of $2,504. A few years ago, when mortgage rates were much lower, a 3.5% mortgage rate would have produced a monthly payment of $1,812, a difference of $692 per month.

2. Home availability is improving, slightly

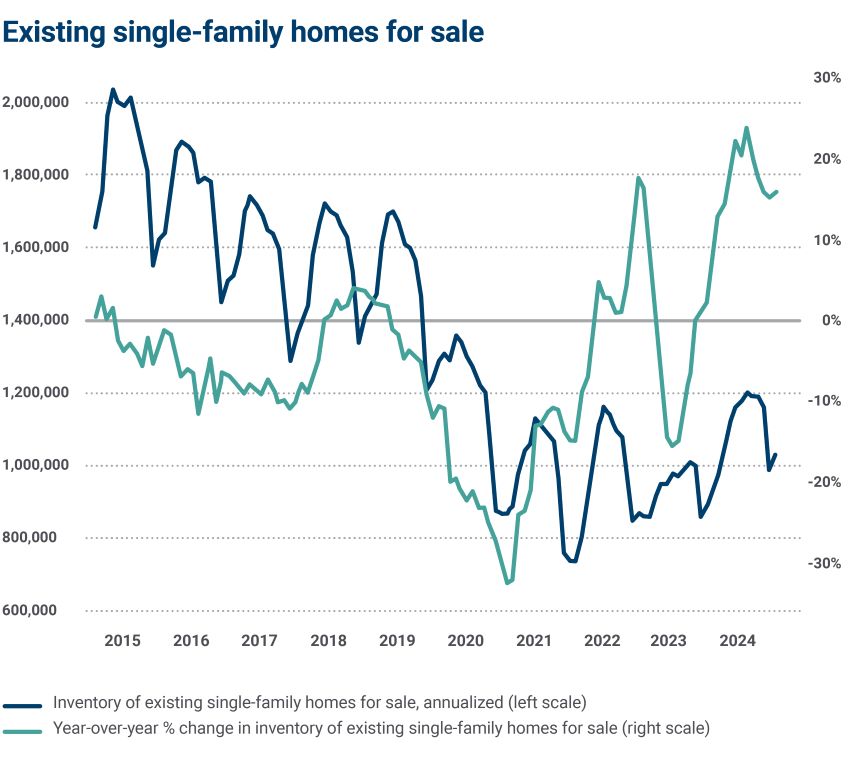

On a positive note, availability in the existing home market has finally been improving. Though still low relative to historical averages, the number of existing homes available for sale was 16% higher year-over-year in January. As seen in the chart below, however, availability remains tight overall.

Source: FactSet

We believe improved availability shows existing homeowners are increasingly coming to terms with today’s higher mortgage rates. Previously, many homeowners were reluctant to move, as they would very likely have faced much higher mortgage rates in doing so. This incentive to stay in place seemed to reduce market liquidity significantly in recent years.

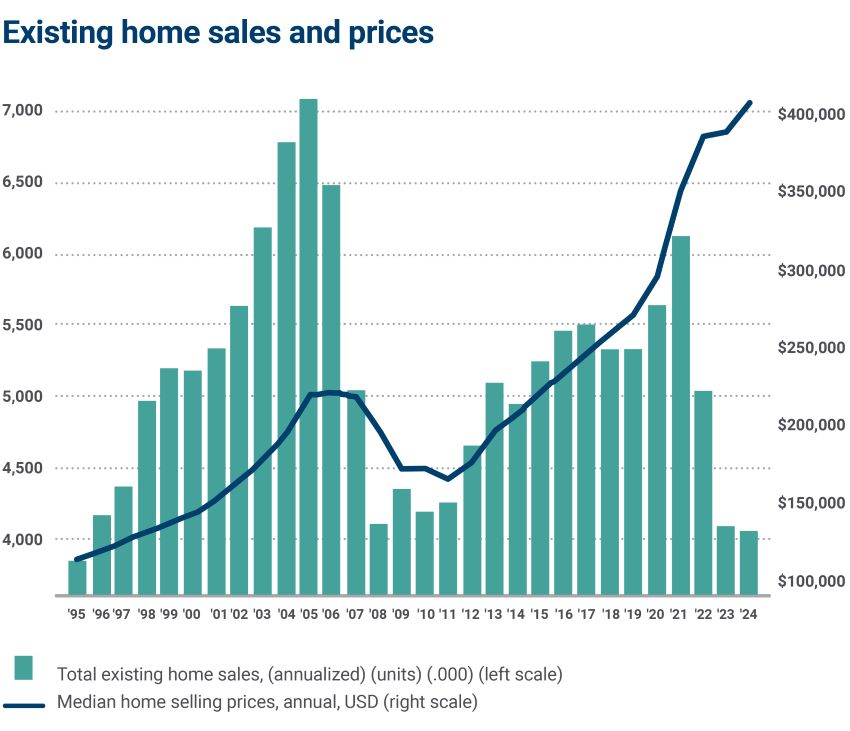

Existing home sales are broadly expected to improve this year as availability increases, but that’s not saying much considering 2024 sales dipped to 4.06 million — their lowest level since 1995, according to the National Association of Realtors (NAR). Overall, we forecast existing home sales to be about 2% to 5% higher this year, with median prices about flat (0% to +5%). High mortgage borrowing costs and high home prices remain the most significant challenges to existing home sales.

In the new home market, high mortgage rates are somewhat less of a problem because homebuilders have the flexibility to buy down mortgage rates or offer upgrades to stimulate sales. In 2024, new home sales were up 2.4%, according to the Census Bureau, while median prices, which ended the year at $420,166, were down 1.2%.

3. Home price increases — and home equity growth — may moderate

As the supply of homes available for sale slowly improves, home price appreciation should moderate. In 2024 the median price of an existing home was $405,267, a 4.5% increase over 2023 levels, per the NAR.

The full-year increase, however, masks a deceleration trend seen in the second half of last year as more homes came to market. In the fourth quarter of 2024, existing home sales were up 7.3% year over year, but median home prices were down 0.8%, according to the National Association of Realtors (NAR).

Source: FactSet

The NAR is looking for moderately better conditions this year. The organization projects existing home sales to be 7% to 12% higher in 2025, on a modest 2% increase in median prices. This outlook, however, is based on an assumption of lower mortgage borrowing costs. The NAR is projecting the 30-year fixed mortgage rate to decline to about 6% from a current 7%, a decline we see as overly optimistic.

National forecast: Home sales and prices

| 2025 | 2026 | |

|---|---|---|

| Existing home sales | +7% to 12% | +10% to 15% |

| New home sales | +11% | +8% |

| Median home price | 2% | 2% |

| Mortgage rate | Near 6% | Near 6% |

Source: National Association of Realtors (NAR), More Home Buyers Expect Rosier 2025 Housing Outlook, December 12, 2024

Bottom line: The outlook for 2025

Affordability remains a significant challenge, but overall, we see the U.S. housing market as healthy. Supply and demand conditions should support market values over the intermediate term while incentivizing new home construction.

Homeowner equity is also at record levels, thus supportive of household net worth. Overall, we believe pent-up demand and a slow improvement in availability should maintain the housing market as a source of economic support for some time.

Talk to an Ameriprise financial advisor about your housing goals

If you have questions about how these housing trends may impact your financial goals, reach out to your Ameriprise financial advisor to discuss.