Investors closely watch corporate earnings and policy changes under a new administration

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — January 21, 2025

The S&P 500 Index and NASDAQ Composite rose last week, following back-to-back weekly declines to start the year. Lighter-than-feared readings on core consumer and producer inflation for December rolled back some investor anxiety, while a batch of strong financial earnings to start the fourth quarter earnings season helped lift sentiment.

U.S. markets were closed on Monday in observance of the Martin Luther King Jr. Holiday. This week, the fourth quarter earnings season kicks into full swing. Preliminary looks at January services and manufacturing activity late in the week should provide early looks at how key segments of the economy are holding up at the start of the year. And notably, market reactions to President Trump’s executive orders and policy agenda could produce bouts of stock and bond volatility should they deviate from expectations.

Last week in review:

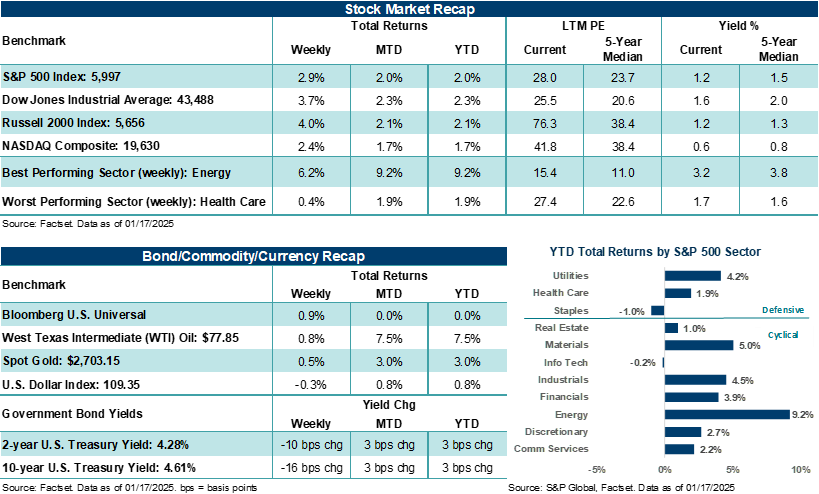

- The S&P 500 rose +2.9% — its largest one-week point and percentage gain since the week ending November 8, 2024. Notably, gains last week were broad-based, with the S&P 500 Equal Weight Index rising +3.9%. Energy (+6.1%) and Financials (+6.1%) led S&P 500 sectors higher.

“The earnings season is always a critical time for financial markets, as corporate updates offer the latest window into an "on-the-ground" assessment of the key fundamentals driving stock prices. Thus, the next few weeks of earnings reports could help calm or intensify current market action.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The NASDAQ Composite and Dow Jones Industrials Average rose +2.5% and +3.7%, respectively.

- The Russell 2000 Index gained +4.0%.

- U.S. Treasury yields fell on the week after inflation updates showed flat-to-lower than forecast levels. However, the 30-year yield touched 5.0% on the week before pulling back.

- The U.S. Dollar Index ended slightly lower, Gold edged higher, and West Texas Intermediate (WTI) crude posted a gain of roughly +1.0%.

- December core CPI increased +0.2% month-over-month, below forecasts and cooler than November’s +0.3% reading. On an annualized basis, core CPI rose +3.2% in December versus +3.3% in November. Notably, core services inflation and shelter costs last month remained largely static versus November levels. Bottom line: While overall progress on inflation has stalled in certain areas over recent months, some of investors’ worst fears about rising consumer inflation were calmed by December’s update.

- Earnings from a few key financial companies last week showed that the profit picture for Q4 was likely strong for corporate America, and the outlook for profits in 2025 appears to be on solid footing as well. Key banks and financial institutions reported earnings results that topped profit estimates while providing upbeat assessments of the outlook for 2025. In our view, strong net interest income trends, solid investment banking/trading activity, and benign consumer/business credit trends at the end of last year all point to a healthy backdrop for the U.S. economy at the start of this year.

- Although retail sales slightly missed forecasts in December on a month-over-month basis, the headline figure grew +3.9% year-over-year — the highest level since December 2023. Spending across categories was broad-based, with auto sales providing strong support.

- Finally, small business optimism jumped to a six-year high in December, as the report showed those expecting the economy to improve (partly based on expectations for Trump 2.0 tailwinds) rose to its highest level since the fourth quarter of 1983. Interestingly, the Russell 2000 Index is back near pre-election levels and has recently flirted with correction territory based on its outsized sensitivity to higher interest rates since early December.

Trump 2.0 begins. And the fourth quarter earnings season ramps up.

On Monday, Donald J. Trump was sworn in as the 47th President of the United States. President Trump is just the second president to serve two non-consecutive terms following Grover Cleveland and the oldest to take the oath of office. In addition to all the pomp and circumstance surrounding the first day a president takes office, Trump signed a series of executive orders that overhaul border and energy policies and rescinded 78 executive actions taken by former President Biden. Some of Trump’s day-one executive actions included withdrawing the U.S. from the Paris Climate Accord, eliminating climate regulations tied to electric-vehicle production, immigration orders, and renaming landmarks. Executive actions also included freezing new regulations (a standard move to help facilitate a smooth transfer of power) and creating the Department of Government Efficiency. Notably absent were specific directives on new tariffs. However, Trump has directed federal agencies to evaluate trade policies and economic relationships with China, Canada, and Mexico and provide appropriate measures by April 1. Throughout the week, investors should see further details regarding the fiscal priorities of the new Trump administration.

On the profit front, early reports from key financial companies at the beginning of each earnings season tend to act as a barometer for the rest of the reporting season. Based on what investors heard last week from the group, the Q4 earnings season is starting on the right foot. With 9% of S&P 500 fourth quarter reports complete, blended earnings per share (EPS) growth is higher by +12.5% year-over-year on revenue growth of +4.7. Notably, S&P 500 profits are currently on pace for their strongest quarter of growth in three years and should help the Index close out its fourth straight year of earnings growth. In our view, favorable profit conditions in the U.S. over a number of quarters have offered a strong support beam for stock prices.

Underneath the surface, Big Tech drivers could again significantly shape investor reactions around the Q4 earnings season. For instance, Information Technology (which is roughly 32% of the S&P 500 by market capitalization) is expected to report the highest revenue growth (+11% year-over-year) of all eleven S&P 500 sectors. Inside of Consumer Discretionary, Amazon.com is forecast to be the largest contributor to earnings per share growth, while Communication Services (which houses Alphabet and Meta Platforms) is expected to post the second highest year-over-year EPS growth rate among S&P 500 sectors.

Along with Big Tech, consumer resiliency has played an important role in lifting stock prices and supporting profits for a number of quarters. However, mixed results/commentary/outlooks from companies over the last few quarters should keep the consumer squarely in focus over the next several weeks. Investors will be looking for more information on the dispersion in spending patterns among low and high-income consumers, as well as ongoing impacts from inflation/higher prices/rising interest rates.

Importantly, we expect companies across industries and sectors that could see impacts from increased tariffs under the new Trump administration to be vocal about what they anticipate from changing policies on their earnings calls. While the rules of the road remain uncertain, analysts and corporate leaders will likely be searching for added clarity over the coming weeks, which could impact corporate profit outlooks and forecasts for the coming quarters.

The earnings season is always a critical time for financial markets, as corporate updates offer the latest window into an "on-the-ground" assessment of the key fundamentals driving stock prices. Thus, the next few weeks of earnings reports could help calm or intensify current market action. Nevertheless, given that we see overall economic and profit conditions remaining positive in 2025, increased volatility across broader stock averages (should it occur) could continue to be greeted as a buying opportunity and/or a chance to rebalance portfolios that have drifted away from targets.

The week ahead:

As touched on above, much of the market’s attention this week will likely fall on new executive orders from the Trump administration and forthcoming policy announcements, as well as a host of earnings updates from corporate America.

- President Trump told reports on Monday that he is thinking about imposing 25% tariffs on Canada and Mexico beginning on February 1. Trump also instructed the Attorney General to delay the TikTok ban or sale deadline by 75 days.

- 43 S&P 500 companies, including 6 Dow 30 components, are scheduled to report fourth quarter profit results. Companies on the docket this week include Netflix, Johnson & Johnson, Procter & Gamble, Union Pacific, American Express, United Airlines, and Verizon.

- December existing home sales, preliminary looks at January S&P Global manufacturing and services PMIs, and December Leading Indicators should all help color the economic backdrop ahead of next week’s highly anticipated Federal Reserve meeting. Market odds suggest there is a near 100% chance the Fed holds rate policy steady this month.