Could investors be on the verge of the long-awaited soft-landing scenario?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — July 8, 2024

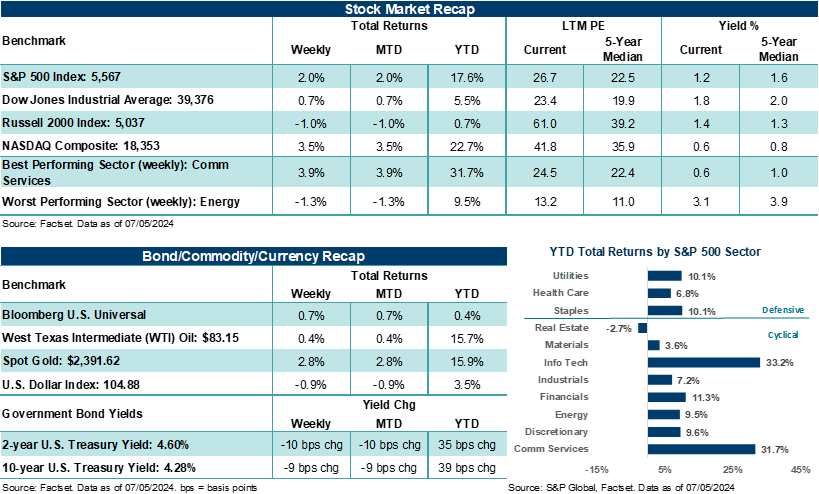

Stocks closed the shortened trading week higher, as the S&P 500 Index posted its fourth positive week in the last five. The Index made its 34th record closing high of the year on Friday after markets were closed on Thursday in observance of the Independence Day holiday. The NASDAQ Composite also finished the week higher, seeing its fifth straight week of gains and hitting fresh new all-time highs. Softer but still solid, employment data kept odds of a September rate hike on the table, while updates on manufacturing and services activity showed further signs of economic normalization.

Last Week in Review:

- The S&P 500 Index rose +2.0%. Market participation continues to show a very narrow focus across a select group of stocks, with Communication Services (+3.9%), Information Technology (+3.9%), and Consumer Discretionary (+3.8%) seeing strong gains last week. However, five of eleven S&P 500 sectors closed the week lower.

- With Big Tech stocks continuing to lead the market higher, the NASDAQ Composite surged +3.5%.

- The Dow Jones Industrials Average again trailed, rising +0.7%, while the Russell 2000 Index slumped 1.0%.

“Several areas of the job market that were running hot last year have cooled this year, helping ease pressures on inflation and rebalance labor conditions.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- Nonfarm payrolls in June rose +206,000, ahead of the roughly +190,000 jobs expected. However, the unemployment rate last month ticked higher to 4.1% from 4.0% in May, while May and April jobs were revised down 168,000. Notably, the previous five months of jobs reports have seen employment gains revised lower from the initial release.

- ISM Manufacturing remained in contraction in June, missing estimates, though saw new orders modestly improve. However, ISM Services also missed estimates and fell back into contraction, seeing its lowest print since May 2020. Importantly, disinflation traction gained momentum across the economy last month, with “prices paid” falling to March levels in the services report and December 2023 levels in the manufacturing report.

- Bond volatility remained in play, with Treasury yields rising at the start of the week as markets began pricing in a more sweeping Republican election victory in November. However, weaker economic data throughout the week, which kept a Federal Reserve rate cut on the table for September, sent U.S. Treasury yields lower on the week. Odds of a Fed rate cut in September ended the week at roughly 78%, up from approximately 65% the prior week.

- The U.S. Dollar Index finished lower by 0.9%, Gold rose by +2.8%, and West Texas Intermediate (WTI) crude gained +0.4%.

- The pressure from campaign donors and some leading Democrats for President Biden to exit the U.S. presidential race intensified. Several public appearances by the President, as well as an interview with ABC News, failed to quell growing concerns about his mental fitness for the job. In the ABC News interview, Biden said he would remain in the race.

- Finally, the UK’s Labour Party returned to power after a historic landslide election victory, securing a majority in the House of Commons for the first time in fourteen years. Sir Keir Starmer replaces ousted Conservative Rishi Sunak as Prime Minister. Labour secured its election victory as voters have grown increasingly frustrated by a series of political and fiscal missteps by Conservatives over the years.

Is the U.S. labor market slowing into a soft-landing scenario?

As noted above, job growth in the U.S. was healthy in June, despite the unemployment rate ticking higher and job gains over previous months being revised lower when the Bureau of Labor Statistics takes a second look. Though open roles in the U.S. unexpectedly climbed to 8.14 million in May from 7.91 in April, the job openings rate was little changed at 4.9%. In the June nonfarm payrolls report, average hourly earnings (a measure of wage inflation) came in line with expectations and sits at its lowest level since May 2021. Notably, job growth has cooled over recent months across Leisure & Hospitality, Professional & Business Services, and Construction. Much of the gains in employment over recent months have come from areas like Education & Health Services and Government. Bottom line: Several areas of the job market that were running hot last year have cooled this year, helping ease pressures on inflation and rebalance labor conditions.

According to Ameriprise Chief Economist Russell Price, CFA, the job market is showing widespread evidence of a long-awaited slowdown. Still, we believe job growth should remain solid enough, and unemployment rates should be low enough to further support consumer income and spending and, by extension, corporate earnings growth.

Corporate profit results and outlooks likely hold the keys to the market’s next move.

Despite stocks hitting new highs, bullish sentiment in the American Association of Individual Investors Survey dropped down to its lowest level since early June last week. Although strong historical returns in the early part of July could keep investor sentiment positive on stocks over the near term, August and September are historically the weakest two-month run of the year for stocks.

And while relatively high market odds point to a rate cut in September, policymakers continue to press a patient and higher-for-longer stance when it comes to monetary policy over the intermediate term. In our view, one or two rate cuts from the Fed this year are unlikely to impact the economy much. Nevertheless, rate cuts could influence how investors interpret the growth environment for the rest of the year and whether stock prices continue to react positively to a soft-landing scenario that keeps economic momentum positive and corporate profits growing. Yet, weakening consumer trends, narrow market breadth, low stock volatility (a sign of investor complacency), and elevated expectations heading into the second quarter earnings season are reasons to refrain from becoming too euphoric about the current stock environment.

At the same time, worrying excessively about the what-ifs or what can go wrong in the stock market between now and the end of the year is not a productive investment strategy, in our view. Current economic and inflation trends suggest the Fed could have room to cut rates later this year, and importantly, S&P 500 earnings per share (EPS) growth is expected to top +9.0% year-over-year in the second quarter. Notably, the percentage of companies with positive EPS revisions continues to improve, hitting the highest level since 2022, according to FactSet. In the second quarter, S&P 500 EPS estimates fell just 0.5%, far smaller than the ten-year average quarterly decline of 3.3%.

Bottom line: With eight of eleven S&P 500 sectors expected to post positive earnings growth in the second quarter and stock valuations across several sectors of the Index relatively more attractive than Big Tech, positive results and outlooks from corporate America over the coming weeks could reframe how investors approach the market in the second half. That said, what companies have to say in their earnings updates about the outlooks for consumer and business spending, regardless of seasonal factors, will likely be critical to shaping market trends as we move deeper into the summer months.

The Week Ahead:

Fed Chair Jerome Powell will head to Capitol Hill this week to deliver his two-day semiannual Monetary Policy Report to Congress. We expect the Chair to keep tight-lipped about future rate policy and retread known positions on the economy and inflation. Key updates on inflation and the start of the second quarter earnings season line the week.

- Thursday’s June core Consumer Price Index (CPI) is expected to hold steady versus May levels. Friday’s June Producer Price Index is also expected to see little change on a headline and core basis versus the prior reading.

- A preliminary look at July Michigan Sentiment on Friday should also show little change versus June.

Delta Air Lines and PepsiCo kick off the Q2 earnings season on Thursday, with JPMorgan Chase, Wells Fargo, and Citigroup lined up for release on Friday. Over the next two weeks, 48 S&P 500 companies will report Q2 profit results.

Return to My Accounts

Return to My Accounts