Market optimism approaches levels that should give investors some caution

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — December 2, 2024

The S&P 500 Index and Dow Jones Industrials Average capped last week, and the month of November, at record closing highs. In the shortened Thanksgiving holiday week, the S&P 500 posted its 53rd record closing high of the year, while the Dow set a highwater mark of 44,911. Notably, U.S. stocks posted their best month of the year in November, as investors poured roughly $141 billion into U.S. equities over the last four weeks — a record amount, according to EPFR Global.

This week, the focus will turn to U.S. employment trends, with Friday’s nonfarm payrolls report likely influencing whether the Federal Reserve again reduces its policy rate later this month or decides to take a pause heading into the new year.

Last week in review:

-

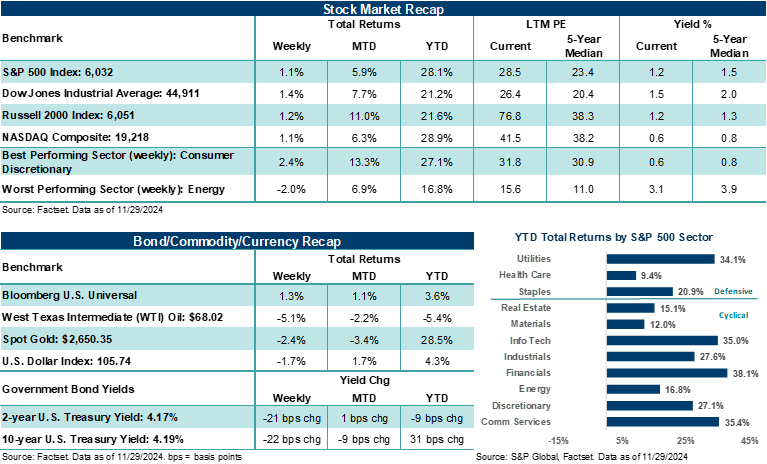

The S&P 500 rose +1.1% on the week and gained +5.9% last month. The Index notched its best month of performance since November 2023. Interestingly, the broad-based U.S. stock average has finished higher in 11 of the previous 13 months and is on pace for its strongest year since 2021.

“As the year winds down, investors should be thankful for the bounty of stock returns seen over the last two years. However, we believe the road ahead could look more challenging than most investors appear willing to recognize at the moment.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The Dow Jones Industrials Average finished the week up +1.4% and ended November higher by +7.7%.

- The NASDAQ Composite ended last week higher by +1.1% and finished last month with a gain of +6.3%. The Tech-heavy index logged its best month since May 2024 and is up in 10 of the past 13 months.

- While stock gains in the large-cap benchmarks were impressive in November, investors' interest has shifted to smaller-cap stocks post-election. The Russell 2000 Index gained +1.2% last week and a very impressive +11.0% in November. Last month’s gains were fueled by a Republican election sweep that could see lawmakers’ lower taxes and regulations next year. Such conditions could help boost profits for smaller domestic companies, which tend to have fewer levers to pull to help lower their effective tax rates or reduce costly regulation expenses.

- U.S. Treasury prices moved higher on the week as yields fell. In November, 2-year Treasury yields largely remained static as odds favor another 25-basis point rate cut from the Federal Reserve this month.

- Gold and West Texas Intermediate (WTI) crude settled lower during the week as well as in November. A ceasefire agreement between Israel and Hezbollah and easing inflation fears acted to tone down some interest in the two areas. That said, Gold is up over +28.0% in 2024, rivaling and outperforming the returns seen in major U.S. stock averages this year.

- The U.S. Dollar Index fell on the week but finished the month of November higher by +1.7%. As long as investors continue to invest in “U.S. exceptionalism” and prospects for a solid 2025 across domestic assets, we believe the dollar will likely remain firm against other developed currencies.

- On the economic front, the Federal Reserve’s preferred inflation measure matched consensus estimates, with the core reading rising +2.8% last month. Personal income rose more than expected in October, while personal spending also came in ahead of estimates. Pending home sales for October showed that homebuying momentum may be starting to build after two years of suppressed activity, while a second look at Q3 GDP remained unchanged at +2.8%. Lastly, weekly initial jobless claims were in line with estimates, while continuing claims pushed past 1.9 million — a three-year high.

- Finally, as Americans emerged from their Turkey-induced comas on Thursday, some headed to the malls, but most went to the couch and pulled out their laptops to spend in force for the holidays. Mastercard Spending Pulse reported that sales on Black Friday rose a healthy +3.4% over Black Friday 2023. However, below the surface, spending was starkly tilted towards online shopping, where e-commerce retail sales jumped +14.6% year-over-year versus in-store sales, which rose by just +0.7%. Interestingly, Black Friday transactions monitored by Adobe Analytics found that online spending rose +10.2% year-over-year to a record $10.8 billion. That sum is more than twice what consumers spent online during Black Friday five years ago.

Market optimism approaches levels that should give investors a little caution.

With eleven months of 2024 now in the books, outlooks regarding next year are beginning to take center stage. We will be publishing our 2025 Outlook and Themes report later this month. But in the meantime, below are some bulleted points that we believe should help temper your expectations for a third year of +20% plus returns across U.S. stocks in 2025.

-

A lot of optimism about an incoming Trump administration has quickly filtered into stock prices. Despite what is bound to be a more complicated road for tax, tariff, and regulation changes next year, investors thus far just want to focus on the positives. Notably, stock valuations on several measures are elevated, and pockets like small caps, which had trailed larger U.S. benchmarks for most of this year on performance, are starting to catch up quickly. Six of eleven S&P 500 sectors are higher by an impressive +25% or more this year and, in several cases, trade at or above their longer-term valuation levels. Healthcare is the only S&P 500 sector not up double digits in 2024 (and it's up nearly +9.5%). With analysts expecting 2025 S&P 500 profits to grow over +14% above this year’s levels, there is very little room for fiscal, monetary, or macroeconomic conditions to disappoint next year.

- The S&P 500 has not experienced a correction this year (i.e., a 10% or more decline from its market top). According to Bespoke Investment Group, the Index has historically experienced such drawdowns every 346 days on average, going back to 1928. Although since 2000, it’s not unusual for stocks to go through longer stretches without a correction, history usually catches up, and a little reset in expectations is needed for stocks to find a new appropriate base. As we often say, corrections help facilitate a healthy and functioning market over the longer term. In our view, the longer the market goes without a correction, the more concerned investors should become.

- While there are always concerns that investors fret about, a record level of stock optimism appears to be pushing aside almost any reasonable level of caution. According to the Conference Board, 56.4% of consumers currently expect equities will be higher in the coming year — a record high going back to December 1987. Potential trade wars, ongoing fighting in Europe and the Middle East, unknown risks regarding U.S. immigration policies next year, and extremely elevated expectations for Big Tech cloud the backdrop for stocks despite very healthy fundamental conditions. At the end of the day, there’s just too much optimism and not enough recognition of what could derail stock momentum for rational investors not to pump the brakes a bit.

- As the year winds down, investors should be thankful for the bounty of stock returns seen over the last two years. However, we believe the road ahead could look more challenging than most investors appear willing to recognize at the moment. That said, we also believe the outlook for next year remains favorable despite the known risks, and stocks could grind higher if fundamental conditions stay on track. A more selective stock approach, a realistic assessment of potential fiscal and monetary policy headwinds or tailwinds, and a well-balanced investment strategy could be the keys to navigating what is very likely to be an eventful 2025.

The week ahead:

Economists expect November nonfarm payrolls will rebound after hurricane distortions and a Boeing strike weighed on job creation in October. ISM manufacturing and nonmanufacturing updates for last month and a preliminary look at December Michigan sentiment will also color the economic backdrop heading into the Fed’s final policy meeting of the year.

-

October job openings (Tuesday) are expected to moderate slightly, while Friday’s November nonfarm payrolls report is expected to show a bounce to +200,000 new jobs from just +12,000 created in October. The unemployment rate is expected to tick higher to 4.2% in November from 4.1% the previous month.

- The ISM reports (Monday and Wednesday) are expected to show an uptick in manufacturing activity last month and a deceleration in services activity. However, the overall economic narrative of manufacturing remaining in contraction, while the services side drives growth in the economy should remain largely unchanged after the reports.