Markets see volatility amid interest rates and tariff uncertainties

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — January 13, 2025

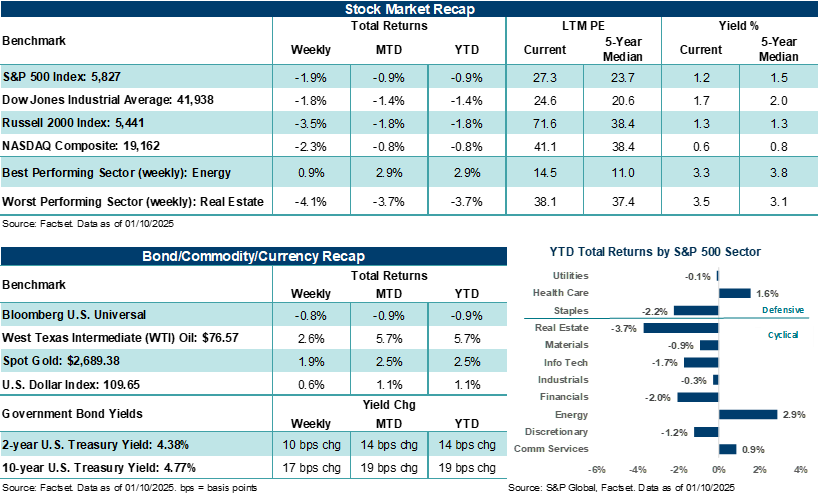

The S&P 500 Index and NASDAQ Composite fell for a second-straight week. For the S&P 500, it was its fourth week lower out of the last five. Notably, the Russell 2000 Index snapped a two-week winning streak and is now back to levels last seen before the election. Much of the week’s focus centered on employment data, which came in stronger than expected and contributed to pushing interest rates higher. In the background, lingering inflation concerns, tariff uncertainties, and stretched stock valuations heading into the fourth quarter earnings season weighed on stock prices.

This week, the fourth quarter earnings season kicks off in earnest with a host of key bank reports likely poised to shape stock direction in the new year. And on the economic front, December consumer and producer inflation reports are expected to show little progress on easing, which could create headwinds for stocks if it further pushes back Federal Reserve rate cuts for this year.

Last week in review:

-

The S&P 500 finished lower by 1.9%. The broad-based stock index is down nearly 1.0% in January after falling 2.8% from its Christmas Eve close through the end of last year — its worst performance during that period on record, according to Bespoke Investment Group.

“We believe markets could act volatile over the near term and possibly see further downside pressure should interest rates creep higher or earnings results and outlooks over the coming weeks disappoint elevated expectations.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

-

The NASDAQ Composite ended lower by 2.3%. The Magnificent Seven were mostly lower on the week, with NVIDIA and Tesla down 5.9% and 3.8%, respectively.

- The Dow Jones Industrials Average (-1.9%) and Russell 2000 Index (-3.5%) also fell on the week. After a strong post-election bounce in November on prospects for lower taxes and less regulation, the Russell 2000 is now down over 3.0% since November 5. Concerns about lingering inflation, slowing growth, and new tariffs have contributed to sapping the post-election euphoria on small-cap stocks.

- Treasury yields again climbed higher, with the 2-year yield climbing to its highest level in three months, while the 10-year yield hit its highest level since the fourth quarter of 2023.

- The U.S. Dollar Index put in its sixth straight week of gains and is higher in fourteen of the last fifteen weeks. Gold ended higher by +1.9%, and West Texas Intermediate (WTI) crude rose +2.6%, finishing the week at its highest level since October 7.

- The market is back in a “good news on the economy is bad news for stocks” enviornment. Simply, economic and inflation data that remains strong likely leaves less room for the Federal Reserve to cut its policy rate in the front half of this year and maybe beyond. Thus, higher rates for longer have recently challenged some market participants’ assumptions regarding a macroeconomic backdrop that includes strong growth and rate cuts for this year. Note: In our 2025 Outlook report, we included just two 25-basis point rate cuts for this year in our base case assumptions. And in a favorable scenario, where growth is coming in stronger than expected, the Fed may not cut rates at all in 2025. However, it's still much too early in the year to draw any hard conclusions on what the Fed may or may not do this year.

- Helping feed concerns about a strong economy, which could lead to less rate cuts and a higher terminal rate in 2025, was last week’s employment data. December nonfarm payrolls grew by a very impressive +256,000, well above the consensus estimates of 150,000 to 160,000. In addition, the unemployment rate fell to 4.1% in December from 4.2% the prior month, with average hourly earnings (a measure of wage inflation) coming in at 3.9%. Combined with a solid December ADP private payrolls report last week and stronger-than-expected job openings in November, the U.S. employment picture remains on very firm ground. All else equal, investors should cheer for good news on the labor front rather than wish for weaker data that could lead to more rate cuts but will likely be accompanied by much higher levels of economic uncertainty.

- Adobe released online shopping data for the 2024 holiday period, which runs from November 1 to December 31. According to its report, consumers spent a record $241.4 billion online this holiday, up +8.7% over the 2023 holiday shopping season. Strong consumer spending online during the holidays was driven by net new demand and not higher prices. In fact, Adobe’s Digital Price Index shows e-commerce prices have fallen for 27 consecutive months and was down 2.6% year-over-year in November.

- In other items, a preliminary look at January Michigan sentiment showed one-year ahead inflation expectations jumping to their highest level since May. A look at the December FOMC meeting minutes showed policymakers see upside risks to inflation but expect inflation to move toward its 2.0% target over time. Notably, policy messages around new tariffs complicated the market’s assessment of near-term impacts. A Washington Post report highlighted that new tariffs from the incoming Trump administration would be targeted and dialed back, which President-elect Trump said was “wrong”. In addition, other reports highlighted the incoming president could declare a national economic emergency, which could provide broad, legal cover for new tariffs. Bottom line: Markets could remain volatile until investors have a better handle on the shape and degree (and potential retaliatory responses) of a new U.S. tariff regime, which, technically, will begin on January 20.

- Finally, devastating fires continue to ravage parts of the Los Angeles area, including the Pacific Palisades. Some experts suggest the incident could be one of the costliest wildfires in modern U.S. history. Preliminary estimates from AccuWeather put total economic losses between $135 billion and $150 billion. However, several early estimates of “insured” losses have come in around $20 billion.

Taking inventory of where market conditions stand at the start of the year. Stay focused on the North Star.

In our view, stocks have increasingly become rate-sensitive over recent weeks as U.S. Treasury yields have climbed higher. On a one-month basis, the change in yields across the Treasury curve has equated to an outsized two-standard deviation move. Simply, higher Treasury yields make the future earnings of companies (which come with a higher degree of uncertainty) less valuable in the present. Below are a few key headwinds we see facing stocks at the moment.

- Higher bond yields are challenging elevated stock valuations.

- Rebalancing efforts may be putting pressure on mega-cap stocks, which had an impressive run of performance in 2024 and have outsized influence on major U.S. stock benchmarks.

- Stronger-than-expected growth trends, stickier inflation, tariff uncertainties, and a pickup in stock volatility have investors more nervous about the near-term direction of interest rates and stock prices.

At the same time, there are reasons to remain cautiously optimistic about the intermediate-term direction of stock prices.

- Investor sentiment and positioning among traders and hedge funds have become less stretched compared to November following a late 2024 drawdown in stock prices.

- Economic growth remains positive, and labor trends are solid.

- Q4’24 S&P 500 profits are expected to grow at their fastest pace in three years. In 2025, S&P 500 profits are forecast to grow by +14.5%, which would mark the strongest annualized pace since 2021.

- Artificial Intelligence headlines remain upbeat, equity inflows are positive, prospects for merger and acquisition activity look favorable, and consumers are resilient and willing to spend (i.e., on travel and goods).

We believe markets could act volatile over the near term and possibly see further downside pressure should interest rates creep higher or earnings results and outlooks over the coming weeks disappoint elevated expectations. Investors may even see more market indigestion should the Federal Reserve decide to stand pat on rate policy later this month and/or message that additional cuts may be further out in the future. However, fundamental conditions in the U.S. economy and among businesses are solid – a key point that should remain investors “North Star” when it comes to their investment decisions.

The week ahead:

With markets wobbling as of late and searching for catalysts to inform near-term stock direction, key reports on inflation and retail sales this week, as well as the start of the fourth quarter earnings season, will likely carry added weight.

- The December Consumer Price Index (CPI) on Wednesday is likely to show little progress from November levels, with some potential upward pressures coming from gasoline. Tuesday’s producer price inflation report is also expected to show an upward bias on an annualized measure versus November levels. Bottom line: Based on market forecasts, investors shouldn’t expect much relief on the inflation front in December’s update.

- On Thursday, the December retail sales report is expected to show solid gains based on strong holiday spending and a continued uplift in building material sales from hurricanes Helene and Milton.

- On Wednesday, JPMorgan Chase, Goldman Sachs, Wells Fargo, and Citigroup will kick off the Q4’24 earnings season. Fourth quarter S&P 500 earnings per share (EPS) are expected to grow +11.7% year-over-year on sales growth of +4.7%. As always, key Financial earnings at the start of the reporting season usually provide a unique window into the current state of the economy and outlook for consumers and businesses.