Procrastination is an investor's worst enemy

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — September 30, 2024

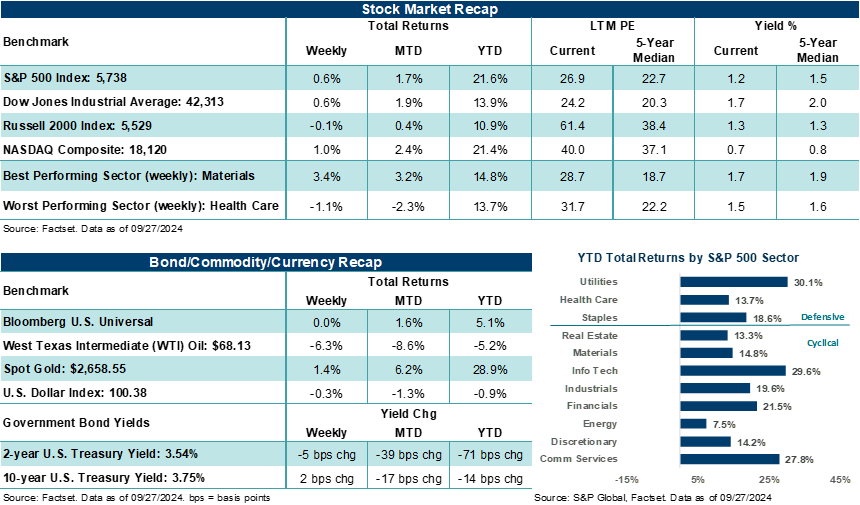

The S&P 500 Index capped its sixth week of gains over the last seven and posted its 42nd closing high of the year last week. Major U.S. stock averages continued to stretch gains following the Federal Reserve's outsized rate cut the week before as well as incoming data last week that showed U.S. economic conditions continue to point to further rate easing ahead. Unexpected and somewhat aggressive fiscal/monetary stimulus announcements out of China also kept global stocks moving higher as the third quarter comes to a close.

Last week in review:

- The S&P 500 gained +0.6%. The Index is higher by +21.6% year-to-date, higher by +1.7% in September, and higher by +2.1% since the Federal Reserve lowered its fed funds target rate on September 18th. Notably, the S&P 500 is on pace for its first positive September performance since 2019.

- Utilities have jumped to the head of the class in terms of sector performance this year, higher by over +30.0%. Come to find out powering artificial intelligence takes a lot of electricity. Renewed interest in nuclear energy capabilities grabbed headlines and stock prices last week. Combined with a recent rotation into cyclical areas outside of Big Tech, Utilities now lead S&P 500 sectors higher on the year, surpassing Info Tech and Communication Services.

- The NASDAQ Composite and Dow Jones Industrials Average gained +1.0% and +0.6%, respectively.

- U.S. Treasury prices ended mixed across the curve, though yields are on pace for meaningful September declines.

- Gold notched another record high, the U.S. Dollar Index moved lower, and West Texas Intermediate (WTI) crude fell.

- On the U.S. economic front, the Fed's preferred measure of core inflation increased less than expected in August, while readings on personal income and spending last month pointed to further consumer normalization patterns. Mixed data on a final look at September Michigan consumer sentiment and the government's consumer confidence figures point to a cautious but still healthy consumer backdrop. Weekly jobless claims came in weaker than expected, while new home sales declined less than expected for August.

- In China, several announcements, including rate cuts and pledges by government officials to ramp up fiscal support to boost economic growth and combat an ongoing residential property slump, helped the Hang Seng Index gain +13%, posting its best week in 26 years.

- In the background, a potential East Coast/Gulf Coast port strike this week, an ongoing Boeing union strike, and rising tensions between Israel and Hezbollah simmered but had little effect on moving stock and bond prices.

“Simply, fear of a recession, which left some investors underexposed to equities this year, never came to pass. The future is always unknown. Are inflation and rates still too high, given the current state of the economy, and does that create a risk of a downturn? Yes. But below the surface, most (if not all) of the elevated inflation today resides in shelter costs. Most components of inflation are running at or below the Fed's 2.0% target. And while policy rates remain high by some measures, they are widely expected to ease back to more normalized levels over the coming quarters.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Procrastination is an investor's worst enemy

Coming into the year, elevated inflation, high interest rates, and slowing consumer/business activity were investors' top concerns, leading some to underweight equities versus their strategic targets for fear the U.S. was on the verge of rolling over into a recession. Instead, inflation has moderated lower all year, government bond yields are on a downward slope, and consumer and business activity has remained resilient.

Simply, fear of a recession, which left some investors underexposed to equities this year, never came to pass. The future is always unknown. Are inflation and rates still too high, given the current state of the economy, and does that create a risk of a downturn? Yes. But below the surface, most (if not all) of the elevated inflation today resides in shelter costs. Most components of inflation are running at or below the Fed's 2.0% target. And while policy rates remain high by some measures, they are widely expected to ease back to more normalized levels over the coming quarters.

Easing inflation and interest rate pressures increase the odds consumers and businesses could remain resilient, which would likely lead to stable-to-growing profit conditions for corporate America over the coming quarters. Boiled down to its simplest form, this type of setup is usually a positive for stocks and a central reason several U.S. equity benchmarks have climbed higher post-Fed decision, despite already strong year-to-date gains.

As we have been reminding investors from time to time over the third quarter, set a disciplined investment strategy and stick to it. With the fourth quarter approaching, use any potential volatility between now and year end to your advantage by deploying a systematic dollar-cost-averaging strategy into high-quality stocks and bonds with excess cash earmarked for investments. Review your risk tolerance and make sure your portfolio has the right balance of stocks/bonds/cash/alternatives based on your goals.

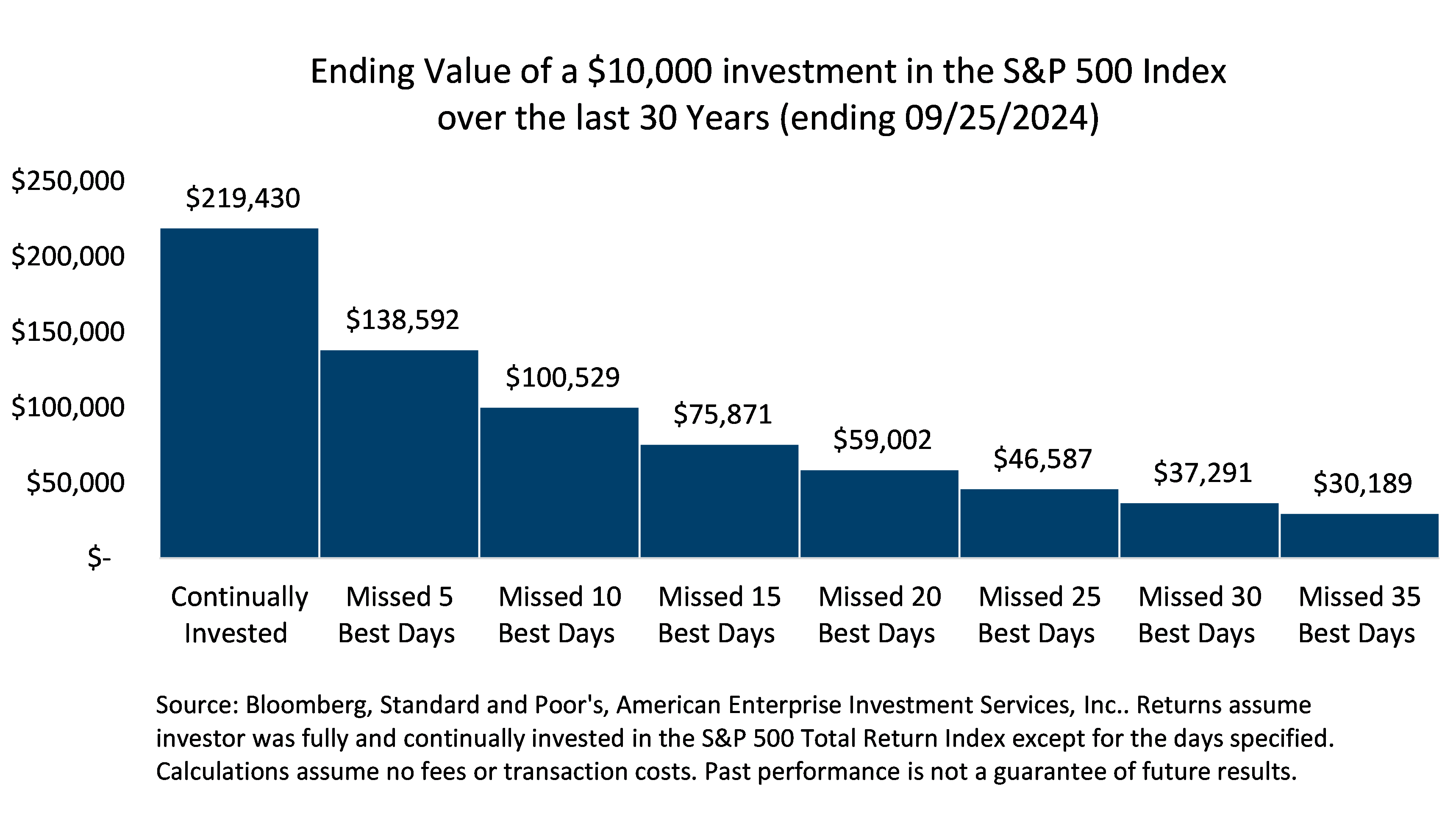

If you've been waiting to get back into the market with cash on the sidelines, history is very clear — procrastination is your worst enemy. The chart at right shows the value of a $10,000 investment into the S&P 500 Index over the last thirty years and subsequently missing the "best" performance days due to market timing, procrastination, fear, etc. Missing just 5 to 35 days over a 30-year window is not a lot of days and seriously impairs an investor's performance. (Note: this example is shown for illustrative purposes only and is not guaranteed.)

Bottom line: Don't let fear of the unknown, concerns about the upcoming U.S. election, the state of the economy, geopolitical tensions, or whatever other reason is preventing you from putting excess cash to work, act to derail your investment goals. The U.S. economy is on a solid foundation, corporate profits are growing, and inflation and interest rates are headed lower. In our view, fourth quarter updates on each of these fundamental factors versus expectations could play a significant role in how asset prices perform through year-end.

Undercurrents that may be less favorable for equities (e.g., Q3 earnings reports that disappoint expectations or drive down 2025 profit estimates) may slow stock momentum for a period as expectations adjust. Of course, some volatility around the U.S. election or a surprise outcome that leads to one-party control in Washington could also put investors on edge for a short time. Still, in our view, that shouldn't derail a relatively healthy fundamental backdrop if a recession is avoided and the stock rally continues to broaden outside of Technology as profit growth expands.

The week ahead:

Key employment updates this week could help shape expectations for the size of the Fed's next rate cut, while a Vice Presidential debate on Tuesday could be the last time before the candidates at the top of the ticket square off.

- Economists expect job growth to continue to cool in September, while open roles ticked down in August. If such conditions are met, market odds for another 50-basis point Fed rate cut in November could increase, which may place a tailwind behind stock prices as the fourth quarter gets moving.

- With 36 days left until the U.S. election, Minnesota Governor Tim Walz and Ohio Senator JD Vance will face off head-to-head in Tuesday's Vice-Presidential debate at 9 pm EST. With early voting already beginning in some states, there is precious little time for the Harris and Trump campaigns to sway undecided voters.

- In the background, updates on ISM manufacturing/services activity, durable/factory orders, and several Federal Reserve speeches, including from Fed Chair Powell on Monday, will grab investors’ attention.