Rate cuts are finally coming. However, a lot must go right for stocks to move higher through year-end.

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — August 26, 2024

"The time has come to adjust policy." That was what Federal Reserve Chair Jerome Powell said to an audience of his peers and colleagues in his speech at Jackson Hole, Wyoming, on Friday, and as expected, it was music to investors' ears. Rate cuts are finally coming.

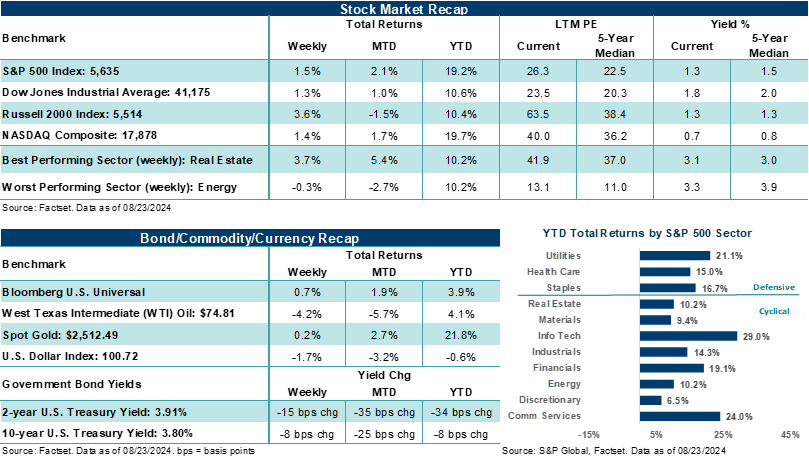

Over the last few weeks, asset prices, including both stocks and bonds, have largely priced in the expectation that the Fed will begin cutting its policy rate starting in September and from a twenty-three-year high. Major U.S. stock averages closed the week higher and added to their gains from the previous week. Notably, after a very rocky start to August for the major U.S. stock averages, all but the Russell 2000 Index is higher month-to-date and heading into the final week of the month.

Last Week in Review:

- The S&P 500 Index rose nearly +1.5% on the week and is up +5.4% over the last two weeks. The two-week gain is the benchmark's strongest since November 2023. The Index has traded higher in ten of the previous twelve trading days. By the end of Friday, 70% of S&P 500 constituents were trading above their 50-day moving average (i.e., a positive indication of broad market participation). On August 2, just 44% of the Index was trading above its 50-day.

- Another positive sign of broadening stock participation was the Equal Weight S&P 500 Index rising +2.1% during the week, closing at a new record high. Real Estate (+3.6%), Materials (+2.4%), Consumer Discretionary (+1.2%), and Industrials (+1.8%) led stock gains.

“With major U.S. stock averages, like the S&P 500 and Dow, back near their high-water marks, investors should be a little more cautious of the near-term ‘direction of travel’ from here. For stocks to grind higher through year-end, profit expectations need to be met, outlooks need to remain largely positive, consumer/business trends need to stay on track, and the Fed still needs to land the plane into a soft-landing. Simply, a lot has to go right for stocks to continue to elevate from here.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The NASDAQ Composite rose +1.4% on the week and is higher by +6.8% over the last two weeks — also its strongest two-week run since November 2023.

- With interest rates moving lower and market odds pointing to a 100% chance of a Fed rate cut next month, the Russell 2000 Index rose +3.6% last week and has gained +6.6% over the previous two weeks.

- The Dow Jones Industrials Average rose +1.3% last week and is roughly 0.5% away from its July high.

- As mentioned above, Fed Chair Powell set the stage for the next phase of monetary policy, noting that downside risks to employment have increased despite the fact that the economy is still growing at a solid pace. Importantly, Mr. Powell said, "The Fed will do everything it can to support a strong labor market," and "inflation is now much closer to the Fed's objective." The July FOMC meeting minutes earlier in the week showed some members of the Fed supported cutting rates at last month's meeting. Taken in total, the path is now set for monetary policy to start easing next month.

- On the economic front, weekly initial jobless claims came in largely in line with expectations, while a preliminary look at August services activity showed an acceleration of expansion from the prior month. August manufacturing activity continued to sit in contraction, and July new home sales unexpectedly rose +10.6% month-over-month as rates eased.

- Vice President Kamala Harris officially accepted the presidential nomination at the Democratic National Convention on Thursday. In her acceptance speech, Vice President Harris touched on her background growing up, the economy, social issues, the border, and national security. The first presidential debate between Vice President Harris and former President Trump is scheduled for 9 p.m. EST on September 10.

- The 2-year U.S. Treasury yield fell below 4.0%, with the 2-year/10-year spread now inverted by just 11 basis points. In a normalized environment, investors should expect to see a positive spread, where they receive a higher yield for lending money longer, compared to lending money over a shorter period. After enduring a negative 2-year/10-year spread since July 2022, investors should expect the yield curve to further normalize as the Fed lowers its policy rate over time.

- Gold rose slightly, touching a fresh record high. West Texas Intermediate (WTI) crude settled lower, finishing the week down five of the last six weeks. The U.S. Dollar Index lost 1.7%.

"The direction of travel is clear." Is it, though?

While that statement is how Fed Chair Powell described forward monetary policy in his speech at Jackson Hole last week, that's likely not the best way to describe how markets may trade over the coming weeks and months. However, it is unlikely investors will see the magnitude of volatility experienced at the beginning of the month through the rest of the year, barring an unforeseen event shock.

As Bespoke Investment Group recently noted, the type of spike in volatility seen at the start of the month has only occurred a handful of times since the early 1990s. Historically, these sudden spikes are not persistent, do not lead to additional outsized spikes, and volatility tends to trend back to where it was before the spike. While this describes the historical trend of volatility shocks, it also explains how the latest volatility spike came and went, as the VIX Index is now back near levels prior to the spike at the start of August.

With major U.S. stock averages, like the S&P 500 and Dow, back near their high-water marks, investors should be a little more cautious of the near-term "direction of travel" from here. For stocks to grind higher through year-end, profit expectations need to be met, outlooks need to remain largely positive, consumer/business trends need to stay on track, and the Fed still needs to land the plane into a soft-landing. Simply, a lot has to go right for stocks to continue to elevate from here. And let's not forget we have an election this year, which historically can lead to some increased volatility as the November contest draws near. Did we mention historically weak stock performance in September? Over the last four years, the S&P 500 has dropped 4.9%, 9.3%, 4.8%, and 3.9% during September.

It's important to remember that volatility cuts both ways. Over recent weeks, we've had a quick drawdown and a reassertion of buying momentum. As a result, major averages are flirting with July highs, with the fundamental backdrop largely unchanged across this period of volatility — other than investors now having high confidence that the Fed is going to cut rates next month and keep cutting into next year. In our view, that's the real rub to consider. If the Fed has to keep cutting, it's likely because unemployment is rising, which could cause consumers to more aggressively pull back on spending, which likely feeds into lower-than-expected profit growth into next year.

Bottom line: Long-term investors should discount where the S&P 500 ultimately ends the year, though our base case year-end target of 5,750 does imply a little more upside. Stick with a high-quality, well-diversified portfolio, have a plan to buy potential stock drawdowns over the next 3, 6, and 12 months, and lock in higher interest rates now with longer-dated fixed-income bonds/funds. In our opinion, it's a plan of action that can help investors stay proactive in a changing market environment and which may not always provide such a clear view of how to travel.

The Week Ahead:

Move over, Powell. It's Jensen Huang's turn to move markets. In our view, NVIDIA's earnings report this week may actually have more impact on the overall market than Powell's Jackson Hole speech last week.

- This week's main event comes from NVIDIA, with the maker of artificial intelligence chips reporting its results/outlook on Wednesday after markets close. Its impact on AI, Big Tech trends, and overall profit conditions in the U.S. are hard to understate given its size and influence today. NVIDIA's chips are highly sought after, they remain the essential engine behind building most AI infrastructures, and Technology earnings for the second quarter would fall by 50% if NVIDIA's profit expectations were excluded. Notably, the company is the second largest by market capitalization weight in the S&P 500 and NASDAQ Composite and accounts for an eye-popping 21% of the S&P 500 Information Technology Index. Given previous earnings reports from companies that buy NVIDIA's chips, profit results in the prior quarter should impress. However, Huang's outlook for continued AI spending/innovation, the company's ability to meet chip demand, and the impacts on profit growth expectations through year-end are the key factors that will likely determine how investors react to NVIDIA's results this week.

- On the economic front, August consumer confidence, a second look at Q2 GDP, home data, and the Fed's preferred inflation measure for July are all on deck.

Return to My Accounts

Return to My Accounts