Will a recession follow interest rate cuts?

Russell Price, Chief Economist – Ameriprise Financial

Dec. 16, 2024

When the Federal Reserve has cut interest rates in the past, U.S. economic activity has tended to recede in the periods following. This pattern has prompted some forecasters to suggest that a similar phenomenon could occur with the U.S. economy in 2025.

We believe that’s unlikely. Here’s why the U.S. economy is not at significant risk for a recession, in our view — even as the Fed lowers rates.

A long period of recession speculation

As the Federal Reserve aggressively hiked interest rates from near zero to over 5% from March 2022 through July 2023, recession predictions proliferated under the assumption that higher rates would slow consumer and business spending. A recession never materialized, however, largely because of the strong financial position of consumers, in our opinion.

Recently, the Fed appears to have turned the corner and embarked on an interest rate cutting cycle with a half a percentage point cut in its overnight lending rate in September and another quarter point cut in early November.

Inflation is not yet to the Fed’s target pace of “about 2%,” but price pressures in most consumer spending categories have become well contained and we believe aggregate inflation rates should continue to ease in the months ahead. The Labor Department’s Consumer Price Index (CPI) for November showed a 2.7% increase versus year-ago levels, with shelter inflation (which accounts for a large part of the lingering inflation pressures) coming in weaker than expected. Excluding the shelter component, prices were a much more modest 1.6% higher.

Why a recession may not follow rate cuts this time

The transition to interest rate cuts has led some forecasters to note that recessions often come after the Fed begins cutting interest rates. Indeed, Fed officials have, at times, waited too long in cutting rates amid deteriorating economic conditions, thus allowing an economic downturn to develop. We do not believe that is the case this time.

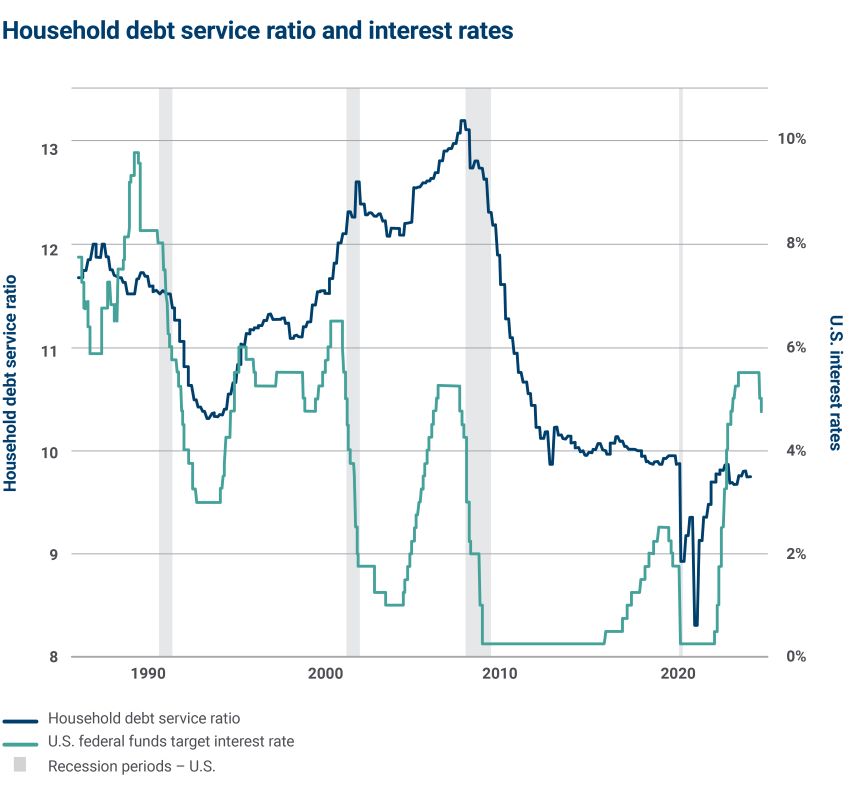

So, what’s different this time? Historically, consumers were often deep in debt during periods in which the Fed was raising interest rates. (See chart below.) As the Fed raised rates to slow economic activity and temper inflation pressures, it made borrowing much more expensive. Consumers would end their “borrow and spend” cycle as a result, and the economy would slow, often before the Fed was able to change course and begin lowering rates to offer economic support. Thus, the economy would often slide into a contraction (i.e., a recession).

Source: The Federal Reserve. The household debt service ratio is the ratio of total required household debt payments to total disposable income. This example is shown for illustrative purposes only and is not guaranteed. Past performance is not a guarantee of future results.

In the current period, consumer finances have been in strong shape in our view, with low aggregate debt burdens, a strong (albeit softening) job market, high home values, favorable financial market performance and what we see as ample savings. When the Fed raised interest rates in 2022 and 2023, it had less impact on consumer activity given consumers had not been relying on borrowing to fuel their spending.

Credit card debt is in decent shape

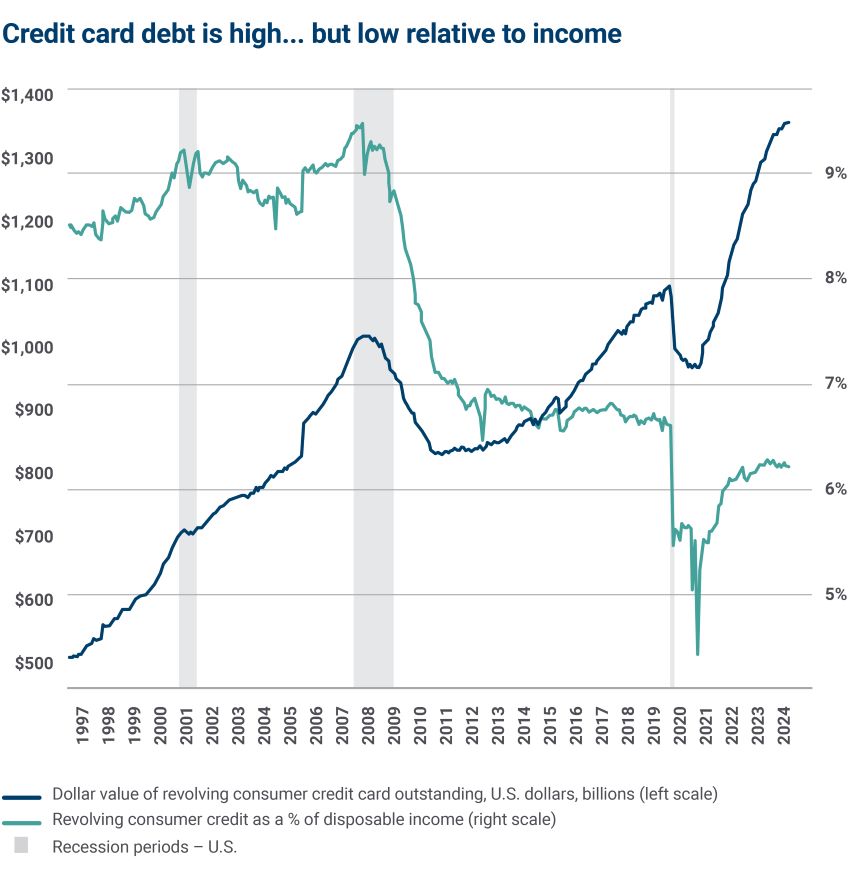

Our views on consumer financial health may seem at odds with often-cited credit card debt figures. In the third quarter of 2024, total credit card debt outstanding reached another new high of $1.17 trillion.

However, credit card debt is measured based on its average monthly balance. As such, the more cards are used for convenience, the higher the dollar value is likely to go. If we view credit card debt relative to aggregate consumer income, the level is reasonably well contained relative to its history.

Source: The Federal Reserve. This example is shown for illustrative purposes only and is not guaranteed. Past performance is not a guarantee of future results.

Bottom line

We believe U.S. economic conditions remain solid and the intermediate-term odds of a recession remain low, despite historical instances when economic activity declined as the Fed began to cut interest rates. As we look ahead, we believe the pace of economic activity is likely to slow somewhat but the continuing financial strength of consumers should result in real gross domestic product (GDP), the broadest and most comprehensive view of economic activity, downshifting to about 2% from its recent strong run rate over the last eight quarters of about 3%.

Navigate different economic cycles with more confidence

If you have any concerns about how the current state of the U.S. economy may affect your personal financial situation, reach out to your Ameriprise financial advisor. They can provide insights on how you can hedge against unexpected events, while also keeping you on track with your short-, medium- and long-term financial goals.