A shift in market sentiment gives life to forgotten sectors

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — July 22, 2024

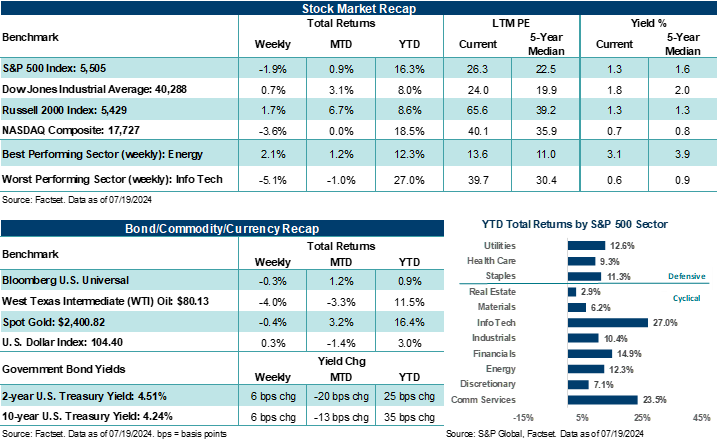

Major U.S. stock averages finished mixed last week. A rotational trade out of Big Tech and growth areas (which led the market higher in the first half) into cyclical areas that are more closely tied to economic conditions colored the week's market activity. As a result, some of this year's performance laggards like small-cap stocks, Energy, Real Estate, and Financials, outperformed on the week. On the economic front, all but four categories measured in the June retail sales report showed month-over-month growth, while initial jobless claims continued to tick higher, and June housing starts/permits surpassed estimates. The Republican National Convention concluded with former President Trump officially accepting the party's presidential nomination after surviving an assassination attempt on his life. A global IT outage ended the week on a down note. And on Sunday, President Biden exited the presidential race as a wave of pressure and uncertainty about his ability to serve as president over the next four years finally sunk his re-election campaign.

Last Week in Review:

- The S&P 500 Index declined by 1.9%, posting its largest one-week decline since the week ending April 19th. The Index snapped a two-week winning streak but is down in just three of the last thirteen weeks.

- The Equal Weight S&P 500 Index outperformed the market-cap weighted S&P 500 by roughly 190 basis points.

“There has been an important shift in the direction of market action over the last week or so and one where the underappreciated have suddenly sprung to life and are now exacting some revenge on the investors who have doubted (i.e., underweighted) their place within a portfolio.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The NASDAQ Composite lost 3.6%, snapping a six-week winning streak. The tech-heavy index also experienced its worst week of performance since the week ending April 19th.

- Although growth stocks were pressured, weighing down the S&P 500 and NASDAQ, the Russell 2000 Index gained +1.7%. Through Tuesday, the small-cap barometer had risen an eyepopping +11.5% over just five trading days, hitting its highest close since December 2021. However, the rapid rise in small-cap stocks lost some momentum as the week closed, given the Russell 2000 Index had hit extremely overbought conditions over the near term.

- At the simplest level, growing confidence in expectations for lower inflation and lower interest rates in the second half have given cyclical areas, or parts of the market more directly tied to economic conditions, a new lease on life.

- The Dow Jones Industrials Average also benefited from the cyclical momentum, rising +0.7%.

- However, semiconductors were pressured on the week following reports that the White House is weighing further controls on China that could limit its access to products that have even a small amount of U.S. technology inside them. In addition, comments from former President Trump about whether Taiwan should pay the U.S. for its defense also kept pressure on the chip space. Bottom line: The White House and Trump understand the sensitivity around Taiwan and the importance of the semiconductor industry to the global economy. We doubt either would willingly enact policies that would risk a downturn in the U.S. economy.

- Speaking of technology, CrowdStrike (a data security firm) triggered a global IT outage after the company released a faulty security update early Friday morning. While a fix was deployed quickly, Microsoft said roughly 8.5 million Windows devices were disabled at one point. Industries such as travel, financials, and a wide range of small-to-mid-sized companies were most affected by the outage. The NASDAQ posted its worst day of performance in two years.

- With roughly 14% of S&P 500 second quarter reports complete, blended earnings per share (EPS) growth is higher by +9.7% year-over-year on revenue growth of +4.7%. Of the S&P 500 companies reporting, 80% have surpassed EPS estimates, while 62% have beaten revenue estimates.

- Treasury yields ticked higher, Gold finished lower (though hit a fresh record high earlier in the week), and West Texas Intermediate (WTI) oil settled lower.

- The U.S. Dollar Index rose after two weeks of moving lower against a basket of currencies.

Revenge of the Rejected

There has been an important shift in the direction of market action over the last week or so and one where the underappreciated have suddenly sprung to life and are now exacting some revenge on the investors who have doubted (i.e., underweighted) their place within a portfolio. U.S. small-caps, Energy, Financials, Industrials, Materials, and Real Estate have all seen a sudden resurgence in investor interest regarding the growing prospects for lower inflation and lower interest rates in the second half. In our view, valuations are more reasonable in these areas compared to growth, which has helped propel investor interest as of late.

In addition, the potential for a Trump 2.0 White House, combined with the possibility of a Republican-controlled Congress following the November election, had investors excited about the possibility of less regulation across Financials, Energy, and Industrials last week, which could spark more merger and acquisition activity. These three sectors account for roughly 40% of the Russell 2000 Index. In addition, the possibility that Republicans could look to lower the corporate tax rate from 21% currently to something lower could have outsized benefits for smaller to mid-sized companies that don't have the same tax levers that larger (multinational) companies can utilize to help lower their tax bill.

Bottom line: Investors have quickly shifted their focus and dollars to areas of the market that have not kept pace with the broader S&P 500/NASDAQ Composite or growth-based areas. This is a positive, in our view. The broadening theme could continue to stretch if economic fundamentals remain solid, profit growth continues, and interest rates and inflation ebb lower.

Importantly, investors should recognize that secular growth trends in areas of technology remain key drivers of the overall market. And there is still a level of risk to the economic outlook given elevated inflation and interest rates. Combined with unknown election results, investors should maintain a pragmatic investment approach that generally balances longer-term opportunities in areas of technology with other cyclical opportunities that are more attractively valued.

The Week Ahead:

The second quarter earnings season kicks into high gear this week, with over one-quarter of the S&P 500 scheduled to report results over the next five days. Thus far, Q2 S&P 500 profits are on pace to post their best year-over-year earnings per share growth since the fourth quarter of 2021. That said, the magnitude of earnings coming in ahead of estimates is below the five and ten-year averages. Bottom line: Companies are mostly beating analysts' estimates, but by less than they normally do.

Big Tech is expected to be a "Big Driver" of second quarter profit results for the S&P 500, and solid results and outlooks from this group could help stem some of last week's selling pressure. On Tuesday, Alphabet and Tesla will be the first of the Magnificent Seven companies to report second quarter results and outlooks. FactSet recently highlighted that just four companies in this exclusive group (Amazon, Alphabet, Meta Platforms, and Nvidia) are expected to see year-over-year second quarter profit growth of +56.4% (combined). In comparison, the other 496 S&P 500 companies are expected to see a combined growth rate of +5.7%. The top-heavy nature of this year's stock returns, concentrated among a handful of companies, has occurred because profit growth is also top-heavy. That said, these four companies' hold on profit growth is expected to wane in subsequent quarters. Given that profit expectations are high for the Magnificent Seven, these companies will have a lot to prove when they report results. At the same time, their outlooks will likely be heavily scrutinized in comparison to elevated valuations.

- Following President Biden's endorsement of Vice President Kamala Harris for the presidential nomination on Sunday, several influential Democrats and donors quickly moved their support behind Harris. PredictIt odds show an 84% chance Harris will be the Democratic presidential nominee, up +30% since Saturday and up +78% over the last month. Given the current stage of the election and campaign finance rules, we believe Harris is likely the most logical choice for the Democratic presidential nomination as she would likely have access to the $96 million the Biden/Harris campaign currently has at their disposal.

- On the economic front, a batch of home data, preliminary looks at July manufacturing and services activity, a first look at Q2 GDP, and June PCE data (the Fed's preferred inflation measure) line the week.

Return to My Accounts

Return to My Accounts