Tariffs: What investors need to know

Russell Price, Chief Economist – Ameriprise Financial

March 12, 2025

This article is intended to provide perspective on how policy outcomes may impact financial markets, the economy and investments. These insights are not political statements from Ameriprise Financial.

The introduction of new tariffs on U.S. trading partners brings a degree of uncertainty to both the economic and market environment in 2025.

Here are answers to your top questions about this type of levy and its potential impacts:

What is a tariff?

A tariff is a tax on imported goods that is paid to the federal government. Tariffs may be imposed broadly, on specific goods (such as steel) or on items originating from a specific country. A country may use tariffs to protect domestic industry, to raise tax revenue or as economic leverage to achieve their geopolitical goals.

How do tariffs work?

With tariffs, the importing entity is responsible for paying the tax, which makes procuring goods or services from certain countries incrementally more expensive. This is meant to encourage the importer to either find a domestic source or source their supply from a different country. However, supply chains, particularly in the manufacturing sector, can take significant time to adjust.

What kind of economic effects do tariffs generally have?

Tariffs can bring side effects for the country enforcing them. A few common economic impacts include:

- Retaliatory tariffs: The countries that are the target of tariffs may respond with their own tariffs.

- Higher prices for consumers: Tariffs may contribute to an increase in inflation and higher prices as companies may pass the cost of the tax on to consumers.

- Slower economic growth: While tariffs may provide a protective boost for domestic companies, they can ultimately slow the overall pace of the country’s economic growth as higher prices may act as a drag on consumer spending.

What tariffs have been proposed and implemented?

Since taking office in January, the Trump administration has proposed and implemented a variety of tariffs on U.S. trading partners. As of this writing, those implemented include a 10% added tariff on Chinese goods and a 25% levy on goods from Canada that are not covered under the U.S. Canada Mexico Agreement (USMCA). A 25% tariff on non-USMCA goods from Mexico has been delayed until April.

In addition, the Trump administration has announced its intention to review trade policy on a country-by-country basis, and potentially roll out reciprocal tariffs in April.

It’s important to note that the situation on tariffs remains fluid and is subject to change rapidly.

How significant are the new tariffs that have been announced?

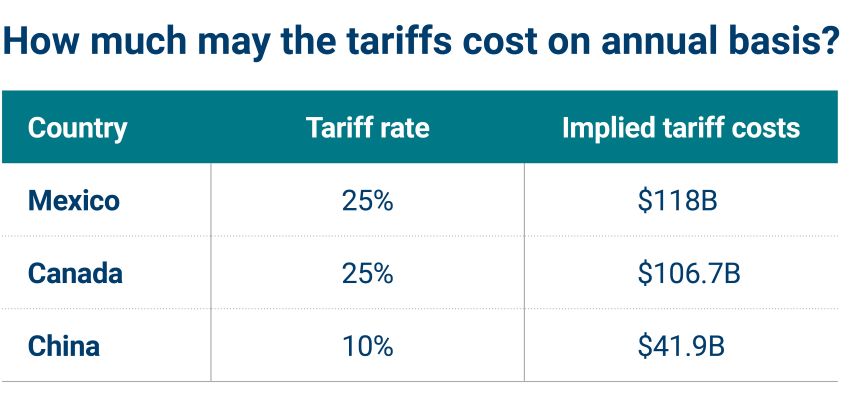

The tariffs invoked against Mexico and Canada, the U.S.’s largest trading partners are likely be quite disruptive, especially if maintained for any length of time. We believe the substantial rates imposed are meant to add expediency to negotiations with Mexico and Canada on border and immigration issues. As for the announced tariffs on China, we believe the incremental 10% is economically digestible and should have little impact on most end-consumer prices.

Source: FactSet. This example is shown for illustrative purposes only.

How may new tariffs impact the U.S. economy and inflation?

On an annualized basis, we estimate that the 25% Mexico and Canada tariffs could boost inflation, as measured by the Consumer Price Index, by 0.5% to 1.0%. Real U.S. economic growth would be expected to decline by a similar amount. These are material values, which lends to our expectation that the tariffs are unlikely to be fully, and permanently imposed.

Over the near term, tariffs on our two largest trading partners, Mexico and Canada could have their greatest impact via border disruptions as some businesses could seek to delay shipments in hopes the tariffs are soon revoked. If so, some U.S. manufacturing operations may need to temporarily shut down, particularly in the auto industry. Additionally, the higher cost for some import items may lead some domestic businesses to hike prices materially.

Tariffs also seem to be contributing to a weaker U.S. dollar, as well as tighter profit margins for the exporter, importer and retailer. Re-sourcing suppliers would be a very long endeavor, especially in such industries as autos, auto parts, appliances, energy commodities, heavy equipment and certain farm goods, among others.

What impact may new U.S. tariffs have on the markets?

Broad tariff implementations could dampen economic growth and put upward pressure on inflation, which would likely be a market negative and could contribute to near-term volatility.

How may new tariffs impact consumers?

Most of the cost of new tariffs is likely to be added to the final price of the good. The potential impact on consumer spending would depend, however, on the pricing power for various goods. For example, if a toy’s price increases from $4 to $5, consumers may not notice, so the volume sold may not change much if the tariff is fully passed on. For a washing machine, automobile or other big-ticket item, however, an added 25% would likely be prohibitive for consumers without a material degradation in sales volumes.

Could the new tariffs become permanent?

The White House has significant leeway to impose near-term tariffs, but lasting trade agreement changes would require Congressional legislation and approval. Bottom line: It’s our view that the implementation of any significant tariffs on U.S. trading partners is likely to be temporary and does not represent a lasting change in U.S. trade policy. We believe higher tariffs on goods from China, however, are likely to be sustained.

Your advisor is here to help you navigate uncertainty

If you’re concerned about the potential impact that economic developments — like tariffs — may have on your portfolio and personal financial situation, reach out to your Ameriprise financial advisor. They can provide personalized recommendations to help you navigate a more uncertain environment.