What new tariffs may mean for the markets

Anthony Saglimbene, Chief Market Strategist – Ameriprise Financial

March 17, 2025

This article is intended to provide perspective on how policy outcomes may impact financial markets, the economy and investments. These insights are not political statements from Ameriprise Financial.

Stocks, investors and humans all generally dislike uncertainty. Yet recently, the whirlwind of tariff announcements and changing specifics around the timing and what’s included in these actions have significantly increased the level of market uncertainty and investor anxiety.

In our view, the magnitude of these levies, the seemingly evolving objectives the White House is attempting to accomplish, and the still undetermined effects of tariffs on the U.S. economy and corporate profits have sapped stock momentum.

Markets have reacted unfavorably to tariffs so far

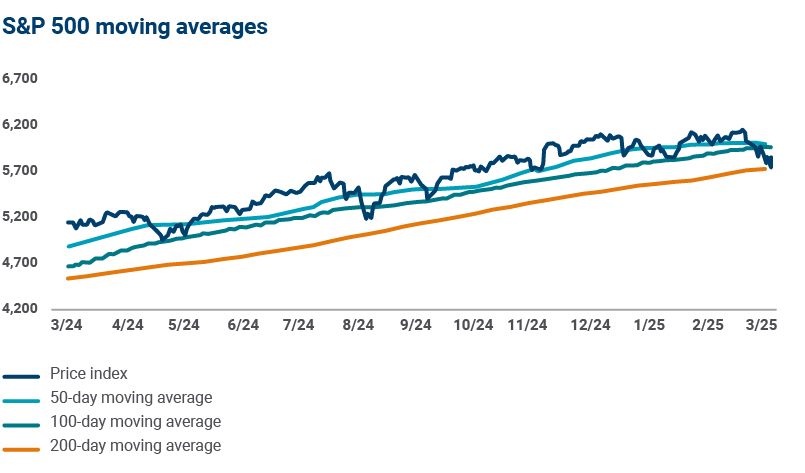

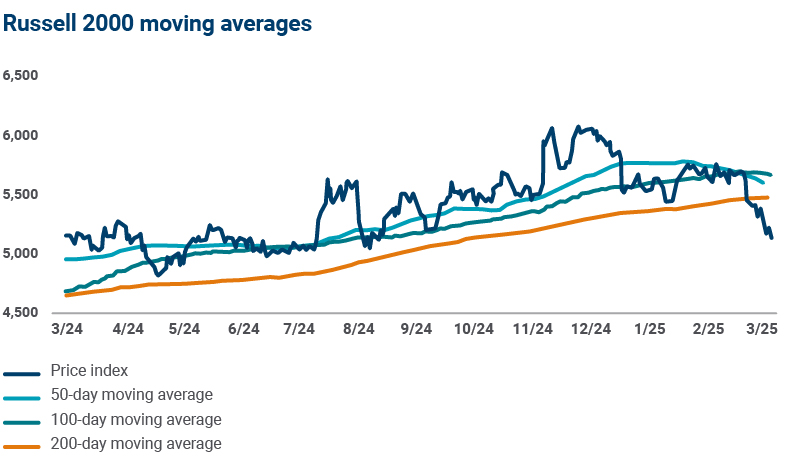

Notably, major U.S. stock averages are now lower since election day, with stocks significantly off their recent highs and trading below their near and longer-term trend lines.

Index Moving Averages are shown for illustrative purposes only and is not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Sources: FactSet, American Enterprise Investment Services, Inc. Data as of 3/6/2025

The White House tariff strategy is currently beginning to erode confidence in future growth, trade stability, sentiment and consumer/business spending outlooks which were forecasted to be relatively solid in 2025 — partly based on the prospects for increased fiscal tailwinds such as lower taxes and less regulation.

At least at present, the fiscal tailwinds investors assumed would help lift stocks this year have taken a back seat to aggressive tariff actions/announcements that are now weighing on equity prices. In addition, the day-to-day news from the White House around tariffs, including last-minute exemptions and new proclamations has clearly unnerved investors, weighed on stock prices and elevated volatility.

U.S. tariffs: Market and economic impacts, explained

Uncertainty surrounding the implementation of U.S. tariffs is likely to be the big economic issue of 2025. Ameriprise Financial Chief Economist Russell Price provides his insights on the future of U.S. trade policy, as well as the potential economic and market impacts. (2:51)

Volatility may continue in the near-term

Unfortunately, we do not believe this environment is likely to change over the near-to-intermediate term, which could keep market volatility elevated. That said, stock prices follow expectations for profits over the next 12 months pretty closely over the long term. Analysts continue to see S&P 500 Index profits rising over the next 12 months.

If the factors discussed above do not meaningfully shift the earnings trajectory lower, we believe longer-term investors should look through these near-term bouts of equity volatility.

However, if earnings projections for the next four quarters begin to flatten or shift down, we believe stocks would likely see further selling pressure.

In this instance, stocks could face a more prolonged period of malaise, which would likely reflect less confidence in an expansionary environment for economic and profit growth this year. In our view, bonds, cash and alternatives may look attractive for new investments in this type of environment.

Learn more: Tariffs: What investors need to know

The outlook for corporate profit growth is not all bleak

It’s not clear yet where the profit trend is headed this year, and there is a risk that a prolonged period of disruptive tariffs could lower the profit outlook over the next 12 months.

Absent this factor, consumers are working and spending, which should benefit profit growth in 2025. Businesses are also spending, and CapEx plans across Tech/AI remain robust. And finally, for several S&P 500 sectors, year-over-year comparisons are easier, and share buybacks offer another lever to manage earnings per share (EPS) growth for cash-rich companies — absent an unexpected drop in demand. Despite the forming clouds, we believe it might be too early to sour on the outlook for corporate profits — or equity markets — this year.

How can investors navigate this period?

We believe keeping a close eye on S&P 500 profits can help investors filter out some of the noise currently coming from Washington.

For investors trying to navigate through the uncertainty, well-established portfolio diversification strategies, high-quality equities, cash, fixed income, alternatives, income-producing strategies, and real assets can all help mitigate risk and possibly provide a little ballast in a portfolio, should near-term equity pressure continue. And at some point, investors may want to consider using the dislocation in stocks to their benefit, either through dollar-cost averaging strategies or rebalancing efforts.

It’s a good time to have a candid conversation with your Ameriprise financial advisor about your current investments, allocation and risk tolerance. How would you feel if your portfolio dropped 5% or 10% from here? Is that an opportunity to invest more? And where would you invest? Or would such declines cause you concern or change your strategy? Your financial advisor can help answer these questions and structure a proactive approach to address current market volatility and keep your portfolio on track with your goals and objectives.

Discuss your investment strategy

Connect with your Ameriprise financial advisor to discuss your current risk tolerance, asset allocation and investment strategy to help weather unsettled market conditions and potentially take advantage of opportunities.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Ameriprise Financial associates or affiliates. Actual investments or investment decisions made by Ameriprise Financial and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances.

Some of the opinions, conclusions and forward-looking statements are based on an analysis of information compiled from third-party sources. This information has been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial. It is given for informational purposes only and is not a solicitation to buy or sell the securities mentioned. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as advice designed to meet the specific needs of an individual investor.

Alternative investments cover a broad range of strategies and structures designed to be low or non-correlated to traditional equity and fixed-income markets with a long-term expectation of illiquidity. Alternative investments involve substantial risks and may be more volatile than traditional investments, making them more appropriate for investors with an above-average tolerance for risk.

There are risks associated with fixed-income investments, including credit (issuer default) risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer term securities.

Stock investments involve risk, including loss of principal. High-quality stocks may be appropriate for some investment strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with investing in stocks, as they can lose value.

An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Definitions of individual indices and sectors mentioned in this article are available on our website at ameriprise.com/legal/disclosures in the Additional Ameriprise research disclosures section.

The S&P 500 Index is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value (shares outstanding times share price), and its performance is thought to be representative of the stock market as a whole. The S&P 500 index was created in 1957 although it has been extrapolated backwards to several decades earlier for performance comparison purposes. This index provides a broad snapshot of the overall US equity market. Over 70% of all US equity value is tracked by the S&P 500. Inclusion in the index is determined by Standard & Poor’s and is based upon their market size, liquidity, and sector.

The NASDAQ Composite index measures all NASDAQ domestic and international based common type stocks listed on the Nasdaq Stock Market.

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Russell 2000 includes the smallest 2000 securities in the Russell 3000.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.