What’s holding the market back at the start of 2025?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — January 6, 2025

Last week included the S&P 500 Index closing out a second straight year of +20.0% plus annual returns, opening 2025 on a down note, and closing the week lower as investors appeared to take a more defensive posture. Trading activity was relatively light throughout the week, with market participants preoccupied with wrapping up the holidays and positioning for the new year. Market-moving economic releases were also light, with fresh looks at manufacturing activity and initial jobless claims doing little to change the overall fundamental narrative.

This week, expect market participants to fully reengage in trading activity and volumes to normalize amid a heavy schedule of economic releases, including Friday’s highly anticipated December nonfarm payrolls report.

Last week in review:

-

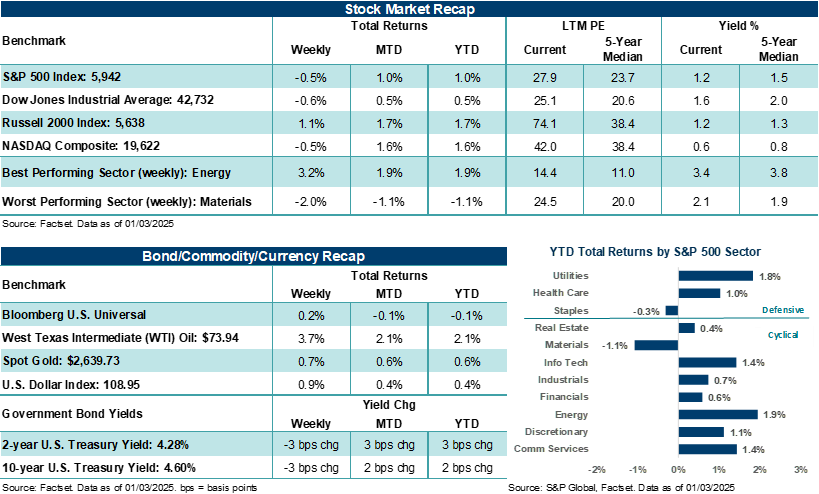

The S&P 500 and NASDAQ Composite each ended lower by 0.5% after closing in the red on the first day of trading in 2025.

- The Dow Jones Industrials Average fell 0.6%.

“While the picture of solid fundamentals continues to cast a mostly positive outlook for where stock prices can go this year, the lingering and unanswered questions about tariffs and policy direction amid elevated stock valuations appear to have stalled the market recently.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- All three major U.S. stock averages finished the seven-day Santa Claus rally window lower. Historically, the period is fertile ground for stocks to grind higher, which starts on December 24 and includes the final five trading days of the old year and the first two trading days of the new year. For the Dow, the failed Santa rally is its first since 2016. However, the S&P 500 notched its second consecutive failed Santa rally, while the NASDAQ logged its fourth straight loss during the holiday window. On the bright side, these types of market statistics have little to no bearing on how stocks trade moving forward.

- The Russell 2000 Index bucked the trend last week and gained +1.1%. But that’s after its miserable performance in December. More on that below.

- U.S. Treasury yields dipped slightly lower on the week. However, the 10-year U.S. Treasury yield closed 2024 at 4.57% after starting the year at 3.88%. The rise in yield weighed on Treasury prices in the final quarter of last year, particularly as the Treasury curve steepened and the 2/10 spread flipped positive in early September after being inverted since July 2022.

- The U.S. Dollar Index rose +0.9% last week. For all of 2024, the dollar rose +7.0% after softening 2.1% in 2023.

- West Texas Intermediate (WTI) crude settled the week higher by +3.7%. However, WTI was up just +0.1% in 2024, while Brent crude finished lower by 3.1%. Although WTI pushed near $90 per barrel in the spring, prices traded in a pretty narrow band in the final quarter of the year amid slower demand in China and increased output.

- Gold rose +0.7% last week. The precious metal shined bright in 2024, rising +27.5%, logging its best year since 2010. However, Gold fell in the final quarter of last year, logging its first quarterly decline in five quarters.

- Finally, December ISM manufacturing improved to its highest level since March (though it remains in contraction), with new orders again improving. Weekly initial jobless claims fell more than expected, as did continuing claims. And November pending home sales rose for the fourth consecutive month.

A final look at how stocks closed out 2024. And what’s holding the market back at the start of 2025.

After a strong push higher in November following the election, stocks closed mostly lower in December and failed to follow through on scoring a late-year rally to help close out 2024 on a cheerful note. The Dow Jones Industrials Average lost 5.3% in December, while the S&P 500 closed lower by 2.5%. The Russell 2000 Index shed 8.4% in the final month of 2024 as investors grew less certain about the prospects for small-cap stocks under the incoming Trump administration and amid a higher-for-longer rate environment. Notably, the Dow and Russell 2000 Index saw their worst months of performance since September 2022. However, the NASDAQ Composite gained +0.5% in December as Tesla and Alphabet outperformed.

The S&P 500 and NASDAQ Composite ended the fourth quarter higher, gaining +2.1% and +6.2%, respectively. Each Index notched its fifth straight quarter of gains and set several new highs in the final three months of 2024. That said, the Dow (+0.5%) and Russell 2000 (+0.01%) saw much smaller gains in Q4. Interestingly, stocks experienced a big rally in November following a Trump win, as animal spirits, the prospects for lower taxes and regulation this year, and the removal of the election overhang sent investor sentiment climbing higher. However, already record allocations to U.S. stocks, high expectations for growth in 2025, concerns about tariff and inflation impacts from a Trump 2.0 administration and stretched equity valuations tempered stock enthusiasm in the final month of the year.

In 2024, the S&P 500 gained +23.3%, while the NASDAQ Composite rose +28.6%. For the S&P 500, 2024 marked the second straight year of +20.0% plus gains. The S&P 500 logged 57 fresh record closes last year, with performance across the Index largely driven by outsized gains across the Magnificent Seven as well as other artificial intelligence-related stocks.

For some perspective, the Magnificent Seven saw an average gain of roughly +57% in 2024. The gang of seven now accounts for over one-third of the S&P 500’s entire market capitalization weight, and their size and influence on the benchmark for U.S. stocks is unprecedented, even when compared to the dotcom era. Gains across the other major stock averages in 2024 trailed Big Tech-related behemoths, with the Dow gaining +12.9% last year and the Russell 2000 Index settling higher by +10.0%. In any other year, and when not compared to Tech, those returns would be very respectable and considered a win by investors.

Over the last two years, the S&P 500 is higher by nearly +58%, its best two-year run since 1997-1998, while the NASDAQ Composite is higher by over +87%, its best two-year run since 2019-2020. So, what did the S&P 500 do after rising by that much in the late 1990s? In 1999, the S&P 500 went on to increase another +20% before the onset of the dotcom bust in 2000.

Stocks were able to climb higher in 2024 and outperform expectations coming into the year based on AI tailwinds, firm economic conditions, falling inflation, and easing central bank policies. If stocks are going to continue their winning ways in 2025, profit growth will likely need to accelerate in non-tech areas this year, economic conditions will need to remain stable, and to some extent, fiscal and monetary expectations will likely need to be met. While “guarded optimism” sums up our 2025 outlook, we expect more bumps in the road this year compared to the last couple of years.

As the calendar has shifted to 2025, the market continues to have difficulty building upward momentum and needs some new catalysts to re-inspire investors. While the picture of solid fundamentals continues to cast a mostly positive outlook for where stock prices can go this year, the lingering and unanswered questions about tariffs and policy direction amid elevated stock valuations appear to have stalled the market recently.

High interest rates, the path for fiscal spending this year, and very high expectations for growth across AI have also complicated the investing picture. Rebalancing effects may also muddy the waters early this month, as large index heavyweights that captured the bulk of the returns last year potentially see some pressure as proceeds are distributed to other parts of the market. And maybe the simplest explanation to help contextualize recent market headwinds is that stocks just need to take a breather after a strong run higher last year. At least this early in the year, it’s as good an explanation as anything else.

Nevertheless, we believe investors are best served by reviewing our suite of Outlook reports published near the end of last year for themes and investment guidance we believe can help support their portfolios in 2025.

The week ahead:

The 119th Congress is back in session and will certify election results on Monday, ahead of the January 20 inauguration of President-elect Trump. Notably, the U.S. stock market will be closed on Thursday for the National Day of Mourning for the 39th President of the United States, Jimmy Carter.

- FactSet estimates suggest December payrolls grew by +155,000, down from the +227,000 pace in November, while the unemployment rate held steady at 4.2%. In our view, such figures would add to the probability that the Federal Reserve leaves interest rate policy unchanged when it meets at the end of the month.

- Other releases this week include fresh looks at job openings, private payrolls, December ISM services activity, and a preliminary read on January Michigan Consumer Sentiment.

These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Sources: FactSet and Bloomberg. FactSet and Bloomberg are independent investment research companies that compile and provide financial data and analytics to firms and investment professionals such as Ameriprise Financial and its analysts. They are not affiliated with Ameriprise Financial, Inc.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Ameriprise Financial associates or affiliates. Actual investments or investment decisions made by Ameriprise Financial and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances.

Some of the opinions, conclusions and forward-looking statements are based on an analysis of information compiled from third-party sources. This information has been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial. It is given for informational purposes only and is not a solicitation to buy or sell the securities mentioned. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as advice designed to meet the specific needs of an individual investor.

This market commentary is intended to provide perspective on how potential election outcomes may impact financial markets and investments. These insights are not political statements from Ameriprise Financial, nor an endorsement of a particular candidate or political party.

Stock investments involve risk, including loss of principal. High-quality stocks may be appropriate for some investment strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with investing in stocks, as they can lose value.

Investments in small cap companies involve risks and volatility greater than investments in larger, more established companies.

The precious metals market is subject to substantial fluctuations including significant and rapid increases and decreases in value from time to time. Investors must be able to assume the risk of such price fluctuations.

The products of technology companies may be subject to severe competition and rapid obsolescence, and their stocks may be subject to greater price fluctuations.

Past performance is not a guarantee of future results.

An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Definitions of individual indices and sectors mentioned in this article are available on our website at ameriprise.com/legal/disclosures in the Additional Ameriprise research disclosures section.

The S&P 500 Index is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value (shares outstanding times share price), and its performance is thought to be representative of the stock market as a whole. The S&P 500 index was created in 1957 although it has been extrapolated backwards to several decades earlier for performance comparison purposes. This index provides a broad snapshot of the overall US equity market. Over 70% of all US equity value is tracked by the S&P 500. Inclusion in the index is determined by Standard & Poor’s and is based upon their market size, liquidity, and sector.

The S&P 500 Information Technology Index comprises those companies included in the S&P 500 that are classified as members of the Global Industry Classification Standard (GICS) information technology sector.

The NASDAQ Composite index measures all NASDAQ domestic and international based common type stocks listed on the Nasdaq Stock Market.

The Dow Jones Industrial Average (DJIA) is an index containing stocks of 30 Large-Cap corporations in the United States. The index is owned and maintained by Dow Jones & Company.

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Russell 2000 includes the smallest 2000 securities in the Russell 3000.

West Texas Intermediate (WTI) is a grade of crude oil commonly used as a benchmark for oil prices. WTI is a light grade with low density and sulfur content.

The US Dollar Index (USDX) indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. This is computed by using rates supplied by approximately 500 banks.

The Institute for Supply Management (ISM) manufacturing index is a national manufacturing index based on a survey of purchasing executives at roughly 300 industrial companies. It is an index of the prevailing direction of economic trends in the manufacturing and service sectors.

The ISM Services is compiled and issued by the Institute of Supply Management (ISM) based on survey data. The ISM services report contains the economic activity of more than 15 industries, measuring employment, prices, and inventory levels; above 50 indicating growth, while below 50 indicating contraction.

University of Michigan Consumer Sentiment Survey is a rotating panel survey based on a nationally representative sample of households in the U.S. that measures how consumers feel about the economy, personal finances, business conditions, and buying conditions.

Third party companies mentioned are not affiliated with Ameriprise Financial, Inc.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.