During periods of uncertainty in the markets, it can be challenging to determine what, if any, action to take. Your Ameriprise financial advisor is committed to helping you navigate market volatility with personalized advice for your long-term, diversified investment strategy.

This report features market commentary from top Ameriprise Investment Research Group strategists when large market movements occur.

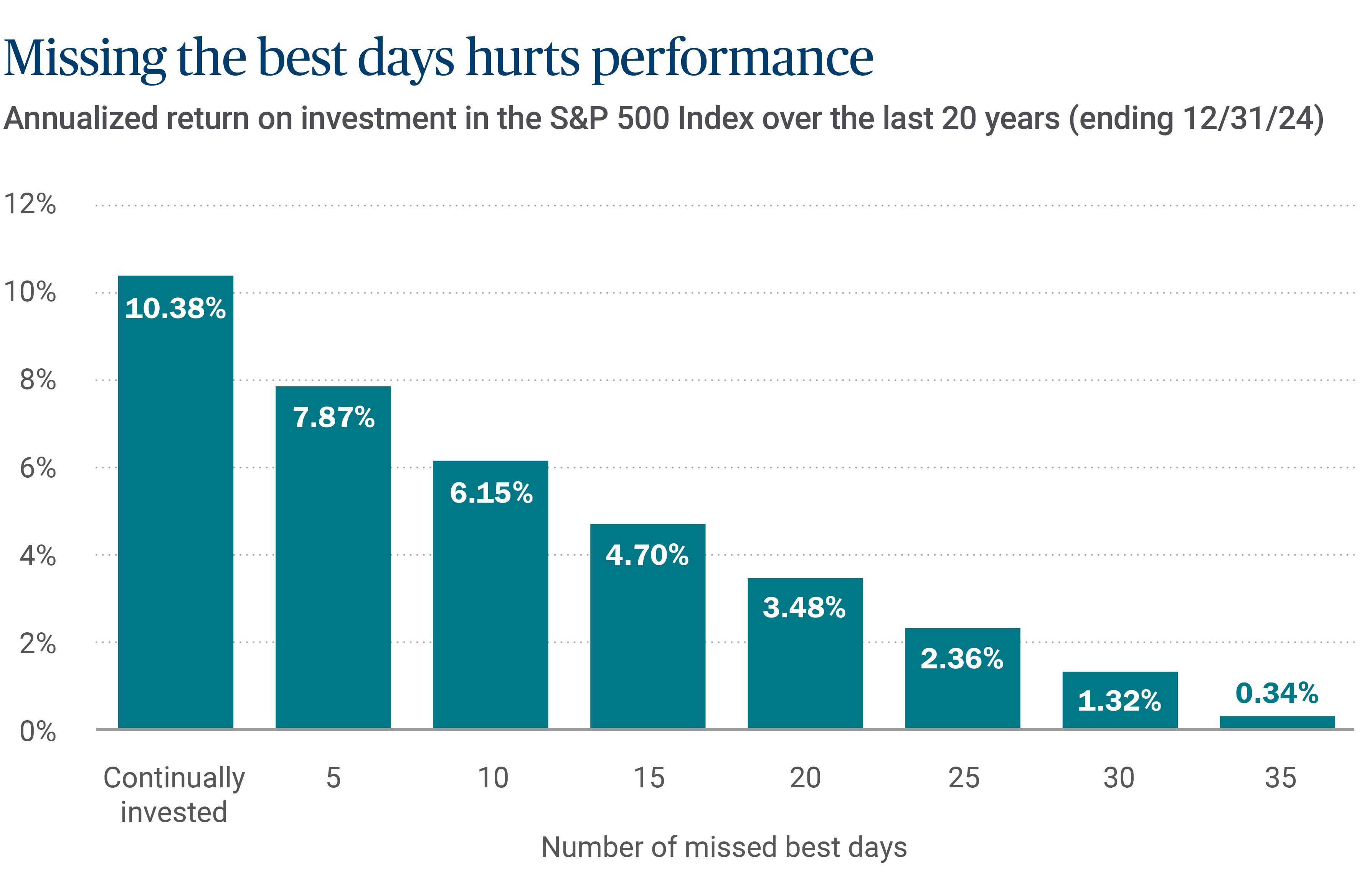

Time in the market beats market timing

Remaining invested through market volatility is generally one of the best ways to build wealth over the long term. Missing out on the market’s best days by reactively selling can erode an investor’s long-term return potential and reduce the probability of investment success. Often, the stock market’s biggest down days occur near the market’s largest up days.

Long-term investment strategies

Staying the course by using long-term investment strategies can pay off over time. Learn more about investing for the long term and how to build a strategy to help you weather any market condition.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.